Investing

It’s a bloodbath across the stock market today. Across major indices, investors were seeing red, but technology stocks took the brunt of today’s sell-off. Looking at major indices, we have:

- Dow Jones Industrial Average: -1.25{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38}

- S&P 500: -2.32{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38}

- Nasdaq-100: -3.65{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38}

- Russell 2000: -1.75{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38}

All were down, but the gap in performance between the small cap-heavy Russell 2000 and the Nasdaq continues to widen since the Federal Reserve made comments on July 11th that increased expectations for interest rate cuts this year.

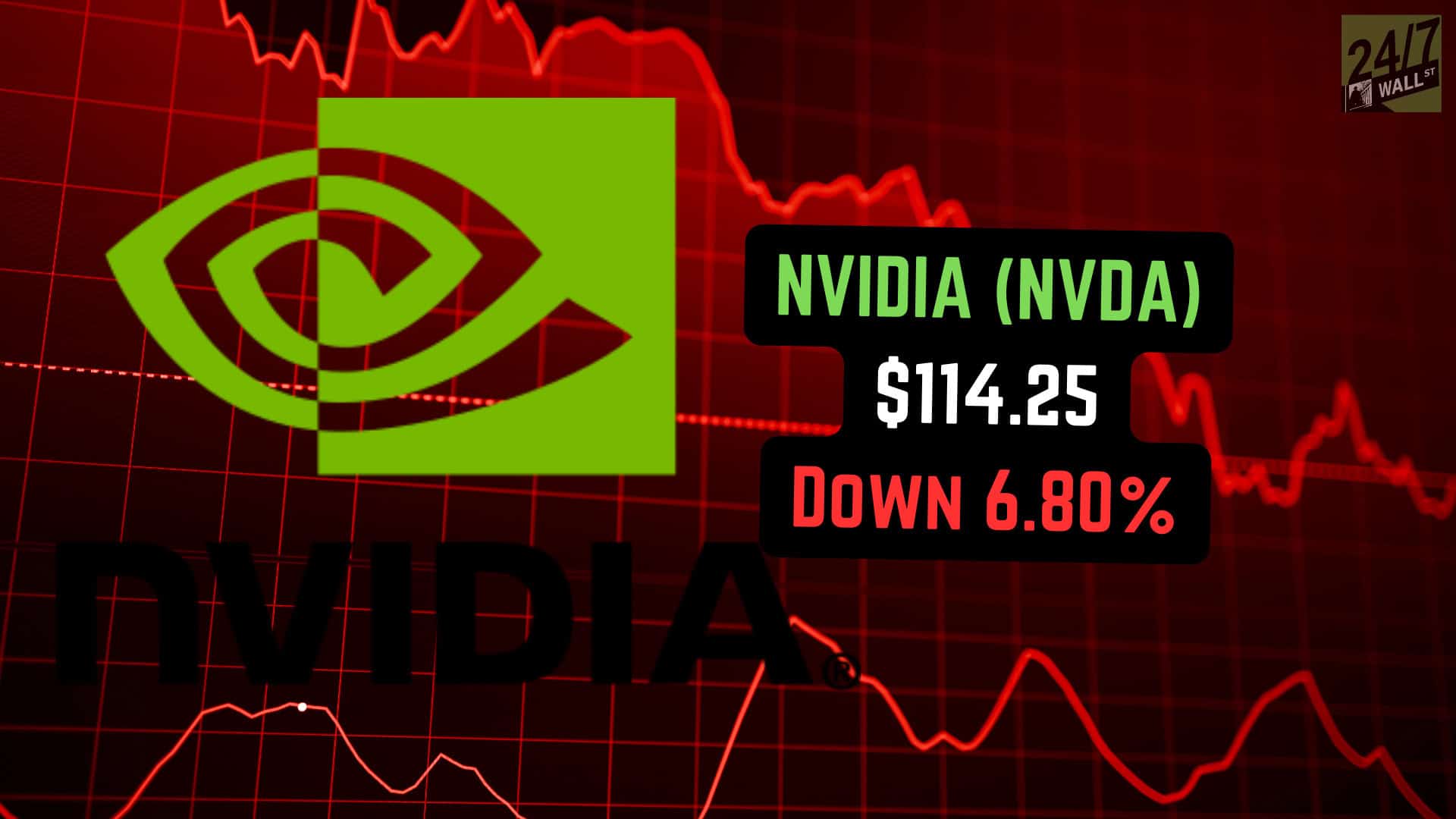

Let’s look at three reasons NVIDIA (Nasdaq: NVDA) and other Magnificent 7 stocks plunged so much today.

Key Points in this Article

- The Nasdaq sunk 3.65{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} on Wednesday, once again underperforming other indexes like the Russell 2000.

- Key reasons for the sell-off in technology included: a continuing sector rotation out of technology, worse-than-expected earnings from Alphabet and Tesla, and muted commentary from Alphabet on artificial intelligence spending.

- If you’re watching stocks sell and thinking it might be time to find some of the most promising AI stocks “on sale,” you’ll want to grab a copy of our brand-new “The Next NVIDIA” report. It outlines stocks that could dominate the next major trend in AI, including a software stock we’re confident has 10X potential.

1.) Continuing Sector Rotation Out of Technology

Source: Lukas Heldak / Shutterstock.com

The need to watch prices in the stock market right now is the gap between indices like the Dow Jones and Russell and the Nasdaq-100. Today, the Dow Jones – which has a higher weighting of value stocks in healthcare, energy, and consumer goods – outperformed the Nasdaq by 2.4{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38}.

In addition, the Russell 2000 outperformed by 1.9{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38}.

The gap between the performance of the Russell 2000 and the Nasdaq-100 began on July 11th and has shown few signs of letting up.

Investors seem to be fleeing “risk” in general. However, as long as there’s more money flowing into value and small cap funds, technology stocks will be under pressure.

2.) Worse than Expected Earnings from Tesla and Alphabet

This earnings season has been off to a bright start, with 80{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} of stocks exceeding expectations so far.

However, with technology stocks having performed so well in the first half of the year, even slight “beats” can be punished by the market.

Google-parent company Alphabet (Nasdaq: GOOG) discovered this today. Earnings of $1.89 came in ahead of expectations of $1.84 while revenue of $87.74 billion also exceeded estimates of $84.19 billion.

Yet, weakness in certain areas like YouTube advertising revenue was scrutinized, and the company fell 5.19{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} today.

Likewise, the market wasn’t impressed with Tesla‘s (Nasdaq: TSLA) earnings, and the stock fell 12.33{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} today. The headline figure in Tesla’s earnings was their $.52 per share profit, which come in below expectations of $.62.

Operating margins contracted from 18.7{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} last year to 14.4{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} in the second quarter. As a car maker, margins at Tesla are heavily scrutinized and reduced margins show the impacts of intense competition in markets like China.

Earnings expectations from the entire Magnificent 7 are significant in the second half of 2024. Investors are banking on a rebound in auto sales from Tesla, a supercycle in iPhone sales from Apple, and NVIDIA’s next-generation Blackwell chips to exceed expectations.

Any slight hiccups will cause some investors across large cap tech stocks to hit the exits, which we saw today.

3.) Muted Commentary on Artificial Intelligence Spending from Alphabet

Source: wigglestick / Getty Images

Finally, a point that is likely putting additional pressure on artificial intelligence stocks is that Google made some muted comments about artificial intelligence spending on their earnings call. The following is from CEO Sundar Pichai:

“Look, I – obviously, we are at an early stage of, what I view, as a very transformative area and in technology where you’re going through these transitions, aggressively investing upfront in a defining category, particularly in an area where in a leverage way cuts across all our core areas of products, including search, YouTube and other services as well as fuels growth in cloud and supports the innovative long-term bets and Other Bets is definitely something for us makes sense to lean in.

I think the one way I think about it is when we go through a curve like this, the risk of under-investing is dramatically greater than the risk of over-investing for us here, even in scenarios where if it turns out that we are over-investing, we clearly – these are infrastructure, which is widely useful for us. They have long useful lives and we can apply it across, and we can work through that. But I think not investing to be at the front here, I think, definitely has much more significant downside.”

That’s a lot to say, but it basically boils down to “we’re over-investing in AI at the moment because the risk is higher of falling behind.”

This is likely the right thing for both Google and other technology companies to do. However, it also points to more risk that large hyperscalers like Google, Microsoft, and Amazon could decide to pull back on spending if they’re not getting enough return on all the capital these massive investments in AI hardware cost to make.

The added uncertainty of quotes like this only serves to put more near-term pressure on the shares of companies like NVIDIA, AMD, and Broadcom.

What are the Best Opportunities in AI Today?

Investors may have sold off AI stocks today, but our bet is demand in the industry will stay red-hot in the second half of the year. If you’re seeing stocks sell-off and thinking it might be time to pick up some leading names “on sale,” then you’ll want to download a complimentary copy of our “The Next NVIDIA” report. It’s available for a limited time only, and the breakthroughs discussed inside are moving rapidly, so don’t delay getting the full story!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.