This week, I came across an article in the San Francisco Gate (which, incidentally, has really ramped up its forex coverage over the last year) that addressed this very topic. Given that part-time forex traders probably outnumber those that practice the craft full-time, such an article was long overdue.

In sum, the author advises part-time traders to concentrate their trading during the busiest times of the day, or failing that, to simply trade the most active currency pairs during the period of the day that one happens to have time to trade. For example, if you wish to trade the USD/EUR but only have a limited amount of time to do so, you are advised to trade the opening of the New York and/or London sessions, at 8AM EST and 3AM EST, respectively. Alternatively, if you only have time to trade from midnight to 2am, for example, you are advised to trade currency pairs in which the quote currency is the Yen, because during that time the Tokyo session is “in full swing.”

Alas, this kind of strategy is based on a very dubious assumption, which is that you should aim to trade the currency pairs which are both the most liquid and most volatile (ignore the contradiction here), because this will yield the most profits. In other words, it’s easy to capture profits when trading pairs that tend to bounce around a lot and which are cheap and easy to buy and sell. Right?

If you read the Forex Blog with any regularity and are ware that my bend is towards fundamental analysis, it’s probably already obvious to you that I don’t think this is necessarily the case. Consider that forex is a zero-sum game. In other words, on average, 50{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} of traders win and 50{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} lose. [When you account for trading costs (i.e. spreads), its probably closer to 30{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} win and 70{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} lose, but let’s ignore this for the sake of argument]. Thus, the way I see it, a trader that enters the market during the busiest times has the same chance of winning (~50{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6}) as a different trader that enters the market during the least busy time of day. Either way you cut it, someone has to win and someone has to lose, and no amount of liquidity or volatility can rectify this situation.

Thus, my advice for part-time traders is to forget trading altogether. If you don’t have the time to constantly monitor the market, pore over charts, and develop technical strategy, the odds of winning are pretty low. On the other hand, why not shift your focus from trading to investing? Trading is difficult under the best of circumstances and even more difficult when you don’t have enough time to make a real commitment.

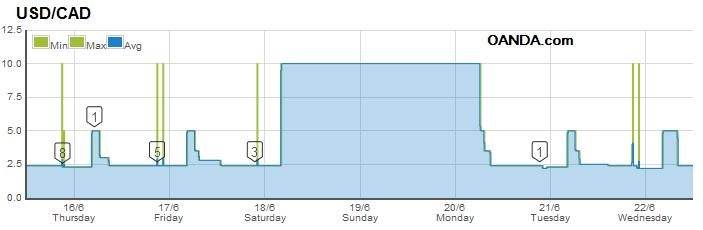

The only way around this is to shift your time horizon from minutes to days – or even weeks. This way, it won’t matter when you have time to trade. Spreads might be marginally higher (as evidenced in the spikes in he chart above, which shows how spreads fluctuate over time) for the USD/EUR at midnight than at 8am, but if you’re planning on holding the pair for more than 10 seconds (and your target profit is greater than 15 pips), this is basically irrelevant.

This way, you also don’t have to worry about carefully planning your entry and exit into positions. Entering a swing trade with a targeted profit of 500pips is probably just as good at 4am as it is at 7am, all else being equal. While this doesn’t necessarily increase the odds of success (above 50{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6}), at least it gives you a great deal more flexibility in being a part-time trader.

SOURCE: Forex Blog| Forex Blog – Read entire story here.