Japanese Yen (JPY) Analysis

- Japanese CPI mostly positive for the Bank of Japan

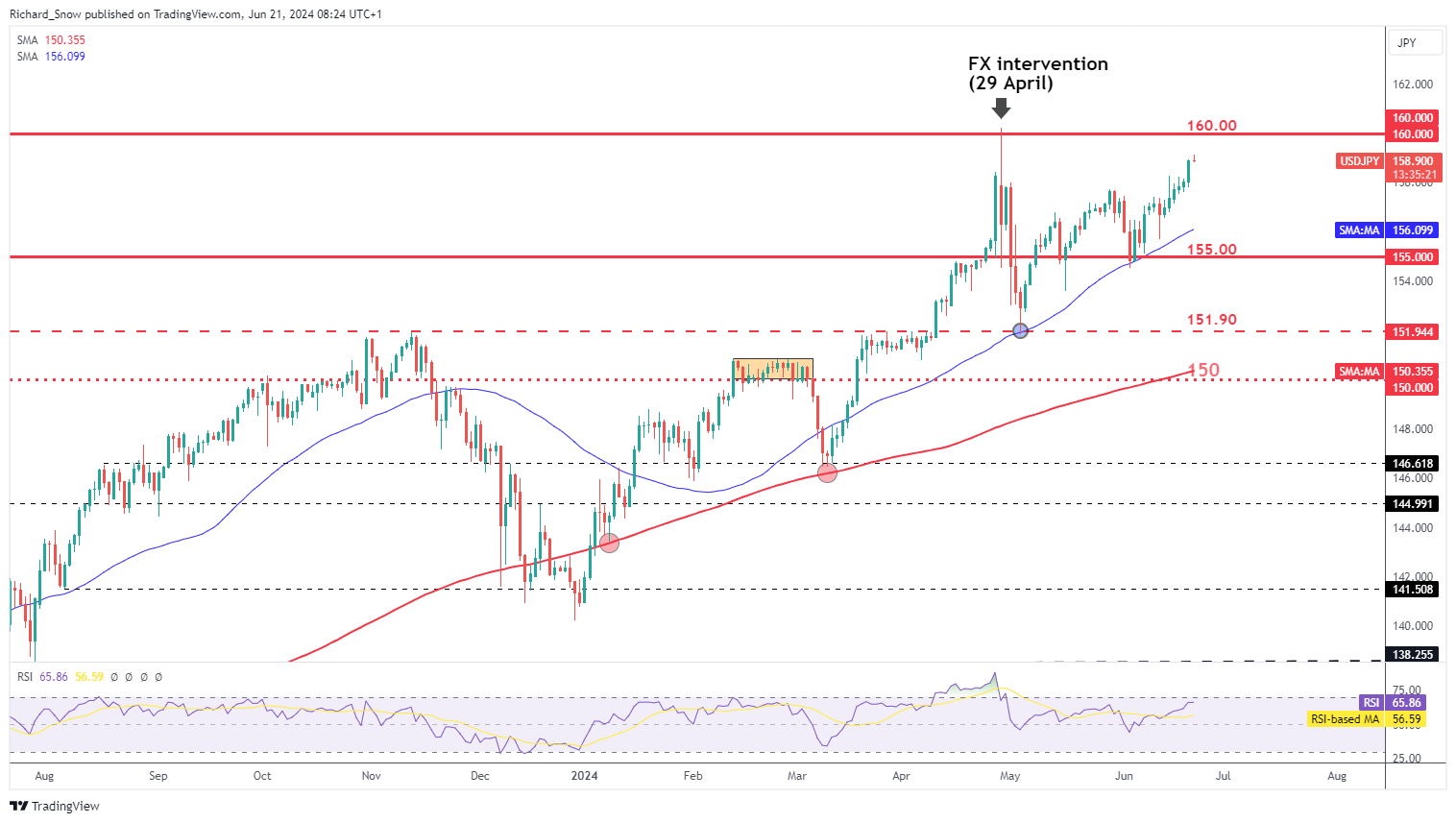

- JPY continues its steady decline to levels last seen before April FX intervention

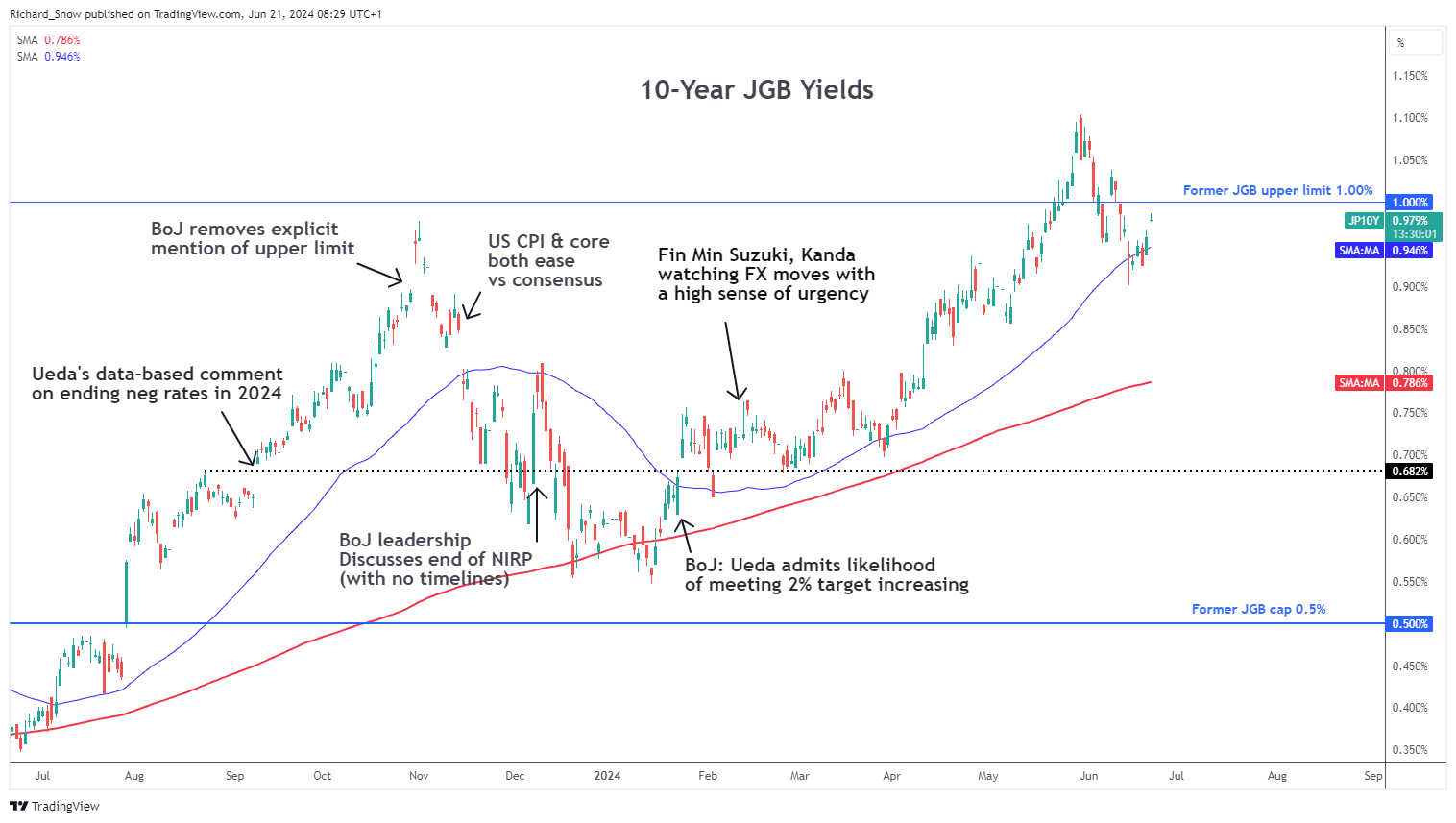

- 10-year JGB yields head higher but have no effect on the yen

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Japanese CPI Mostly Positive for the Bank of Japan

12-month Japanese CPI for May came in above the prior 2.5{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38}, at 2.8{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} while core CPI (CPI excluding fresh food) narrowly missed expectations of 2.6{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} to print at 2.5{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38}. The measure that excludes fresh food an energy, known as ‘core core inflation’, saw a decline from 2.4{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} to 2.1{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38}.

Customize and filter live economic data via our DailyFX economic calendar

The Bank of Japan (BoJ) still requires convincing to hike rates again this year after calling for a virtuous relationship between inflation and wages. Demand-driven inflation as opposed to supply-led price pressures is also a key differentiator when it comes to BoJ thinking around inflation. The drop in ‘core core’ suggests non-volatile measures of inflation are losing momentum at a time when the local economy appears to be contracting (Q1 GDP measured -0.5{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} on a quarter-on-quarter basis). Thus the BoJ will require more data before gaining the necessary confidence to hike the interest rate again.

Learn how to prepare for high impact economic data or events with this easy to implement approach:

Recommended by Richard Snow

Trading Forex News: The Strategy

The Yen Continues its Steady Decline to Levels Last Seen Before April’s FX Intervention

USD/JPY appears to be on a set course towards 160 as the yen continues to weaken. Bond yields have not exactly helped the yen but rising yields over the last two trading sessions now sees the 10-year Japanese government bond yield heading back towards 1{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38}.

While the dollar, measured by the US dollar basket has fluctuated up and down, USD/JPY has been a one-way trade. The threat of intervention is back on the table after Fiji reported that Japan’s top currency official stated there is no limit for reserves in currency intervention and also repeated that officials are monitoring the situation closely.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

The 10-year JGB appears to be heading back towards the 1{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} mark – but this has done very little, if anything, to halt yen declines.

10-year Japanese Government Bond Yield

Source: TradingView, prepared by Richard Snow

| Change in | Longs | Shorts | OI |

| Daily | -12{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} | 6{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} | 2{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} |

| Weekly | -17{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} | 25{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} | 14{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} |

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX