USD/JPY and GBP/JPY – Sentiment Analysis and Charts

You can download our free sentiment analysis on a range of assets using the link below:

| Change in | Longs | Shorts | OI |

| Daily | 13{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} | 3{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} | 4{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} |

| Weekly | 14{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} | 7{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} | 8{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} |

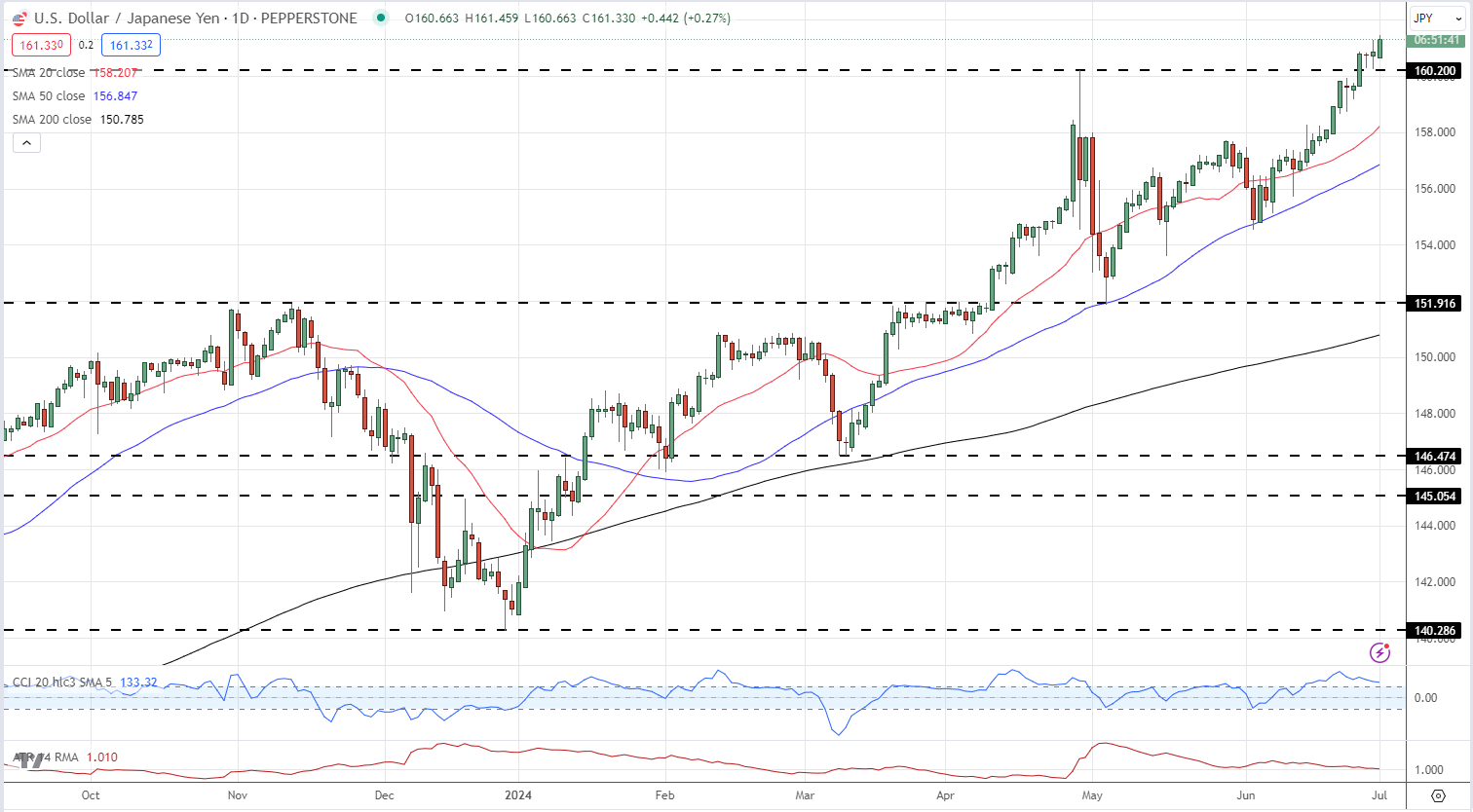

USD/JPY: Decoding Market Sentiment Amidst Shifting Tides

The latest retail traders data paints a complex picture for USD/JPY. Current data shows a mere 17.15{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} of retail traders holding long positions, with shorts outnumbering longs by nearly 5 to 1. Yet, beneath this bearish surface, currents of change are stirring.

Long positions are on the rise, climbing 16.84{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} day-over-day and 9.34{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} week-over-week. While our contrarian approach typically views net-short sentiment as a bullish signal, the recent reduction in bearish conviction hints at a potential trend reversal. This evolving sentiment landscape offers valuable insights for strategic positioning in the USD/JPY market.

USD/JPY Daily Price Chart

Recommended by Nick Cawley

How to Trade USD/JPY

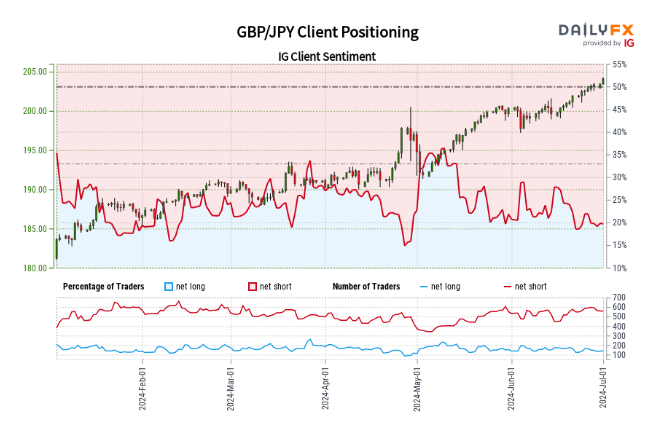

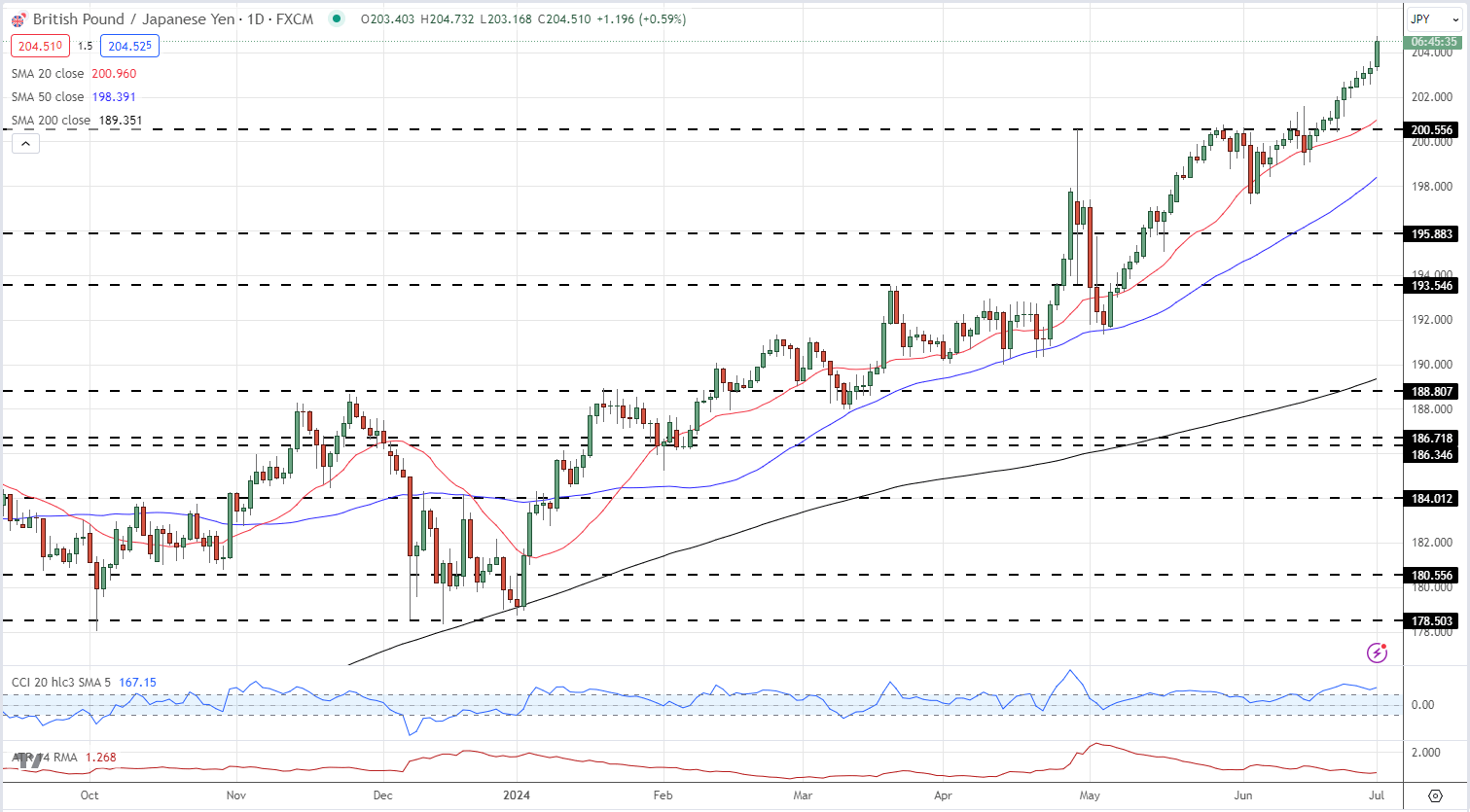

GBP/JPY Market Dynamics: Poised for Potential Upswing

Recent retail trader data reveals intriguing insights into the GBP/JPY currency pair. A mere 19.38{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} of traders are currently maintaining long positions, resulting in a short-to-long ratio of 4.16 to 1. This pronounced bearish sentiment among retail traders often serves as a contrarian indicator, suggesting the possibility of continued upward momentum for the GBP/JPY.

Temporal shifts in trader positioning add another layer of complexity to the market outlook. While the number of traders holding long positions has increased by 8.27{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} since yesterday, it has markedly decreased by 18.64{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} compared to last week. Conversely, short positions have seen growth both on a daily (6.39{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38}) and weekly (3.63{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38}) basis.

This nuanced picture of trader sentiment and its recent fluctuations presents a mixed trading bias for the GBP/JPY. The overall net-short positioning has moderated since yesterday but intensified compared to last week, creating a delicate balance of market forces, and highlighting a mixed trading bias.

GBP/JPY Daily Price Chart

All price charts using TradingView

Recommended by Nick Cawley

Get Your Free JPY Forecast

What is your view on the Japanese Yen– bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.