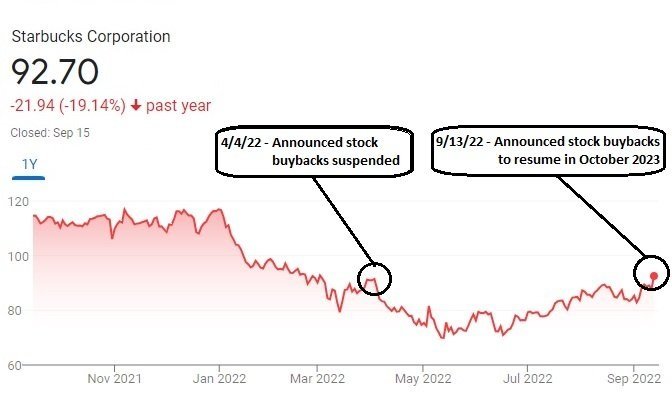

See that wonderful chance for the company to retire shares in the 70’s while sentiment about their relations with employees was at its absolute worst? Yeah, sorry everyone, buybacks were suspended. Yikes.

So if we can’t rely on management to repurchase shares at the best prices, should we swear off the notion that buybacks are shareholder-friendly? A lot of people take that view, but I don’t think it’s entirely fair. Buybacks remain a way to return capital to investors in a tax-efficient manner. Dividend payments force investors to sell a portion of their investment and often results in a tax liability. If you own stock it is safe to assume you want to keep it so forcing a partial sale every three months is not ideal. If you want to sell some, you can do so on your own, and in today’s world for zero commission.

As an investor, it is probably best to think of stock buybacks as equivalent to a tax-free dividend reinvestment program. Your capital stays invested and taxes are avoided, which leaves you and you alone to determine the timing and magnitude of any position trimming. The dividend analogy also rings true because just as dividend payments are executed every quarter no matter the price of the stock, so too are most buyback programs (unfortunately).

All in all, buybacks are probably here to stay even with the new 1{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} federal tax that begins next year. While I prefer them to dividends (for growth companies especially), it is still pretty annoying when companies don’t match their buyback patterns with the underlying stock price volatility. When a cash cow business like Starbucks adopts the same shortcomings, it’s a good reminder that they are the rule more than the exception.

Full Disclosure: Long shares of SBUX at the time of writing but positions may change at any time