Ethereum gas fees continue to drop post-Dencun. Analysts now worry that this will make the network less secure and ETH more inflationary.

When prices tick higher, the crowd gets excited. This behavior is an expected psychological response.

No one wants to miss the crypto boat.

However, in recent months, there has been some worry about Ethereum.

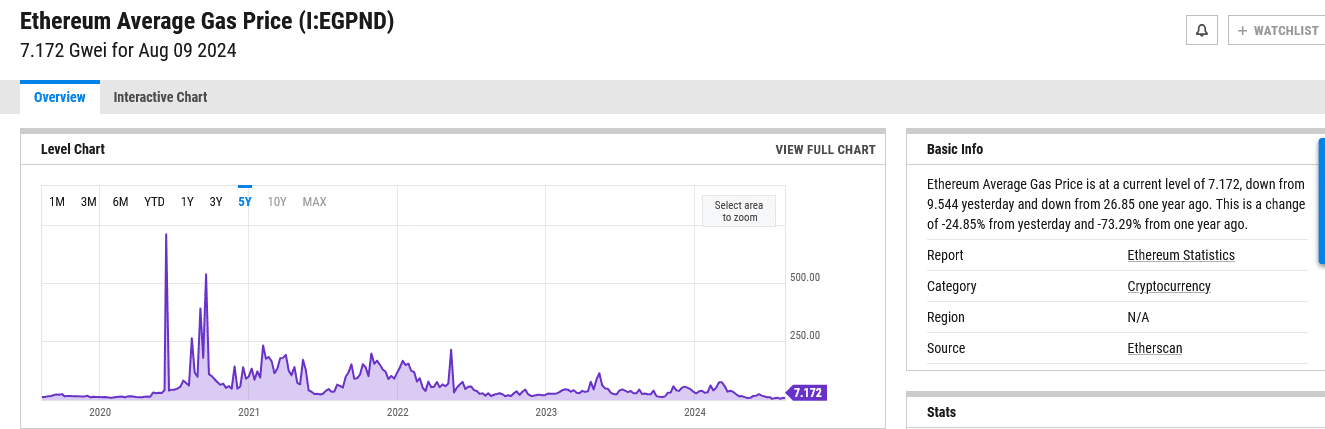

After the spike in May, the cool-off in June, and the volatility throughout July and early August, gas fees continue to drop even lower.

Actually the first time this piece of shit has confluent supports and doesn’t look too bad

I’m actually intrigued for the first time in what feels like years pic.twitter.com/YaBtpMPNMW

— DonAlt (@CryptoDonAlt) August 12, 2024

Yes, this is massive for users (of course, everyone wants to transact without paying a dime).

Ethereum’s Delicate Dance Of Fees And Security

The problem is that Ethereum is a public ledger.

Over one million validators commit their resources to secure the network and process transactions. In return, they can receive block rewards and pay off operation costs.

Validators receive more rewards whenever the gas fee is higher. This is because, besides the block reward, there is a “tip,” a fee that users can pay to be included in the next block.

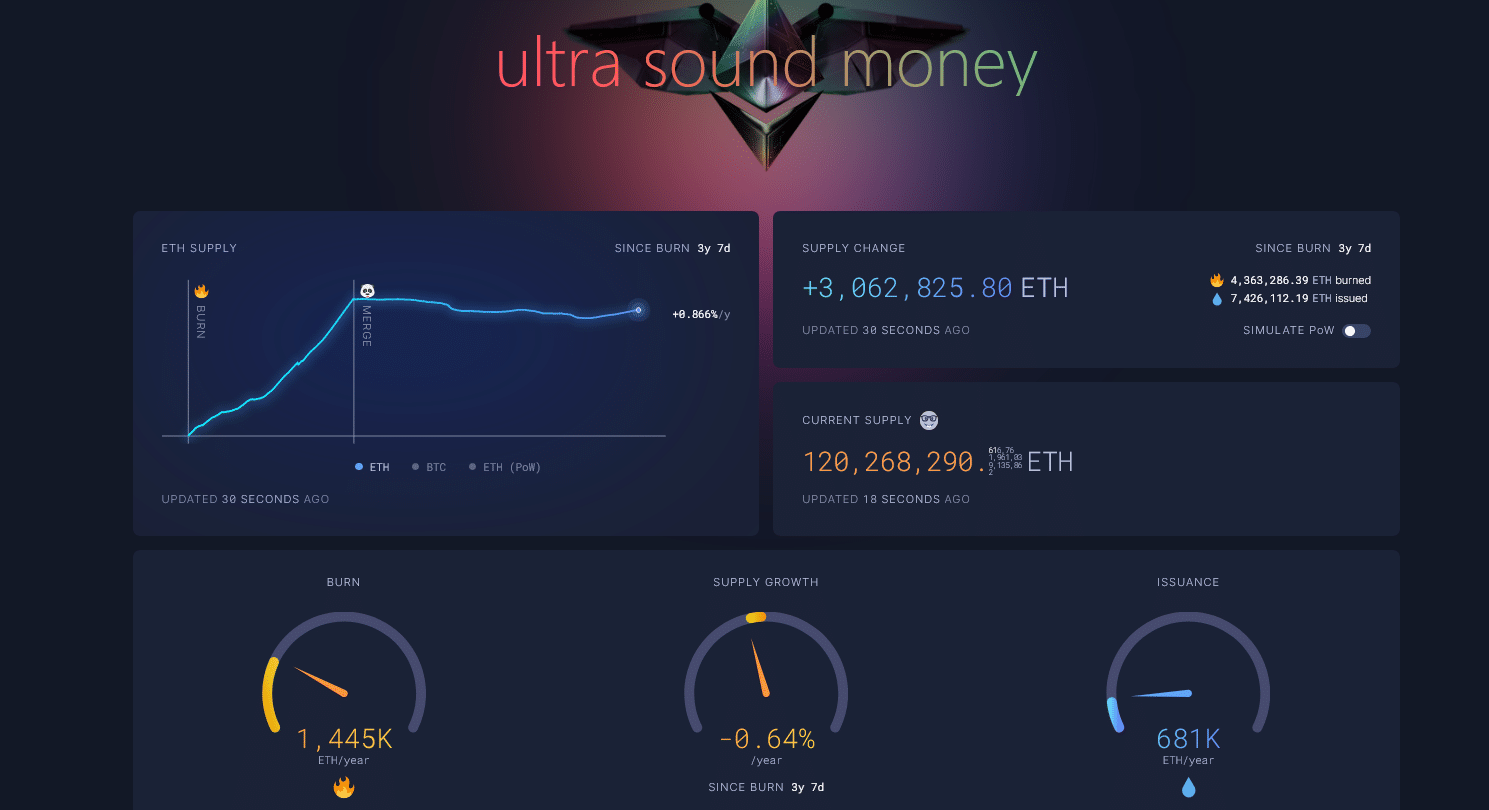

The base fee, after the implementation of EIP-1599, is burnt, helping reduce ETH inflation.

With gas fees now at a multi-month low and falling, some analysts worry that this will impact the network’s long-term sustainability and, thus, security.

Ethereum is designed so that gas fees paid by users (sending transactions or deploying smart contracts) are the lifeblood of the network.

Gas fees incentivize validators to process transactions and help decentralize the network, pushing reliability close to 100{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38}.

Gas Fee Falling, Why?

As of August 11, gas fees remain at just 8 Gwei, a multi-month low, igniting debate about the future of the network.

Gas fees are falling mostly because of reduced on-chain activity, such as NFTs and DeFi.

(Source)

If there is a scramble to mint items on-chain or deploy DeFi smart contracts, fees rise as supply and demand dictate.

However, this is not happening first because of the rise of alternatives, looking at how Solana now dominates meme coin minting and recent upgrades on Ethereum via Dencun that made layer-2 transactions cheaper.

After the Dencun activation in March, developers introduced “blobs” to integrate layer-2 platforms like Arbitrum and Base scale and further reduce gas fees.

Since then, the roll-up fee for confirming layer-2 blocks of transactions on-chain has drastically dropped.

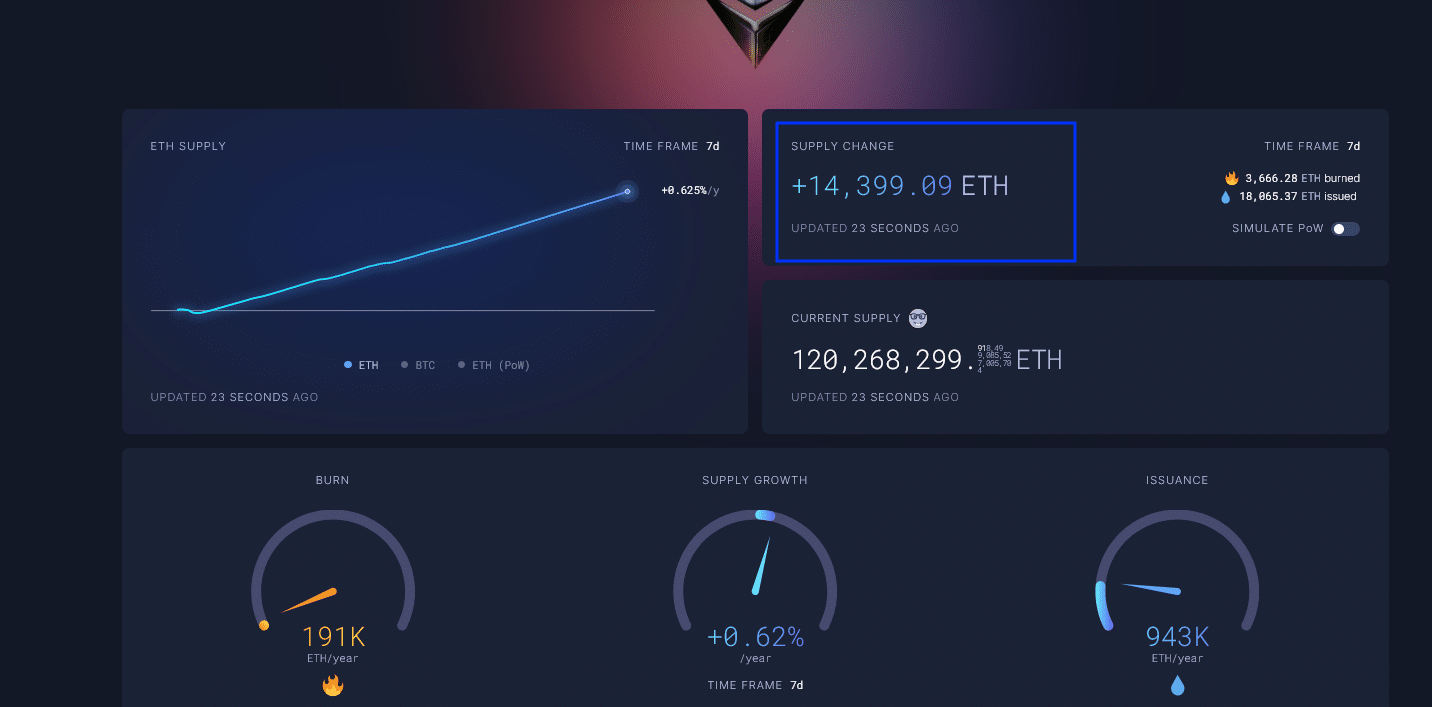

Inadvertently, this has also led to a deflationary crisis for Ethereum.

Fewer coins are now being torched, but more staking rewards are being minted, reversing pre-Dencun gains and making ETH inflationary.

(Source)

With ETH now inflationary, analysts worry this will also impact valuation. At the same time, it may create an environment that makes it easier for malicious players to spam the network.

DISCOVER: How to Buy Ethereum for Beginners – Complete August 2024 Guide

Potential Solutions to Ethereum Gas Fees

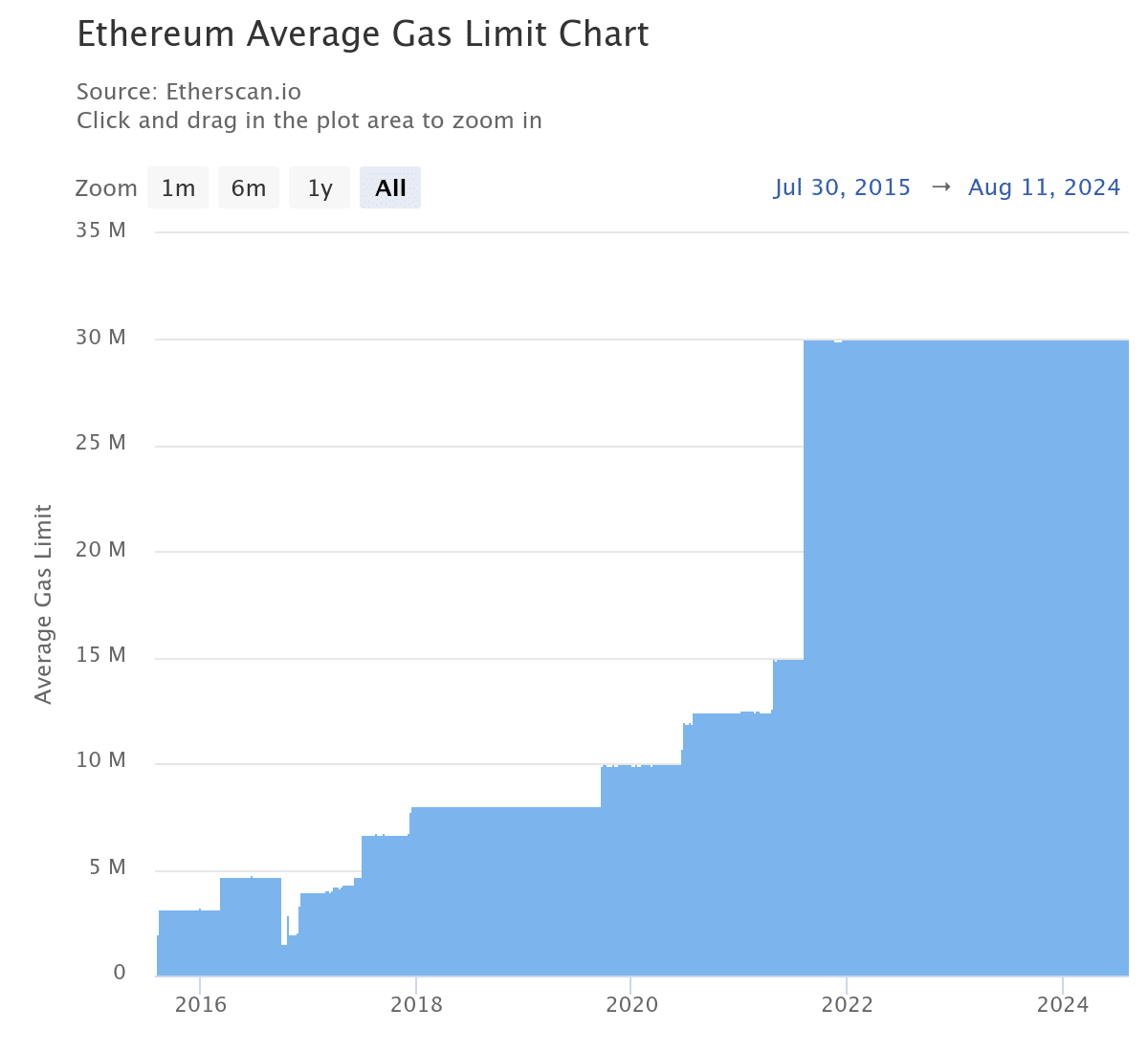

To counter the possibility of malicious agents spamming the network, a proposal to address the gas fee dilemma was floated.

One suggestion is to raise the gas limit, which has remained stable for years. This move would raise validator fees but would not significantly impact users.

(Source)

Analysts propose another option: creating a tiered fee structure. In this model, those who want to transact urgently can pay a higher “priority” fee.

Some are even pushing for layer 2 to play a more prominent role. Here, they will handle most transactions, reducing congestion on-chain and helping stabilize gas fees.

Even if these proposals go live, it remains to be seen whether gas fees will rise and ETH become deflationary in the coming months.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.