Fed minutes at 2pm!

“Chacha-chacha-chacha-chow!”

Fraka-kaka-kaka-kaka-kow!

A-hee-ahee ha-hee!” – Chairman Jerome Powell

Wise words indeed and much clearer than the usual gobbledygook the Fed tries to feed us. This week alone we’ve already had eight (8) distinct animal sounds as we walk along the scary market path:

-

- Michelle Bowman: Focused on U.S. monetary policy and bank capital reform. She emphasized the importance of understanding global economic forces and discussed potential changes to the Basel capital proposal.

- Neel Kashkari: Participated in a Q&A session discussing the U.S. economy and the Fed’s approach to maintaining financial stability. Specific details of his comments were not provided.

- Raphael Bostic: Discussed the U.S. labor market, noting that while it’s slowing, job gains remain robust.

- Alberto Musalem: Addressed financial conditions, economic outlook, and monetary policy. He supported further gradual interest rate cuts but emphasized that future policy decisions will be data-dependent.

- Adriana Kugler: Discussed the global fight against inflation and supported more rate cuts if inflation continues to ease. She emphasized a balanced approach to the Fed’s dual mandate.

- Raphael Bostic: Discussed the U.S. labor market, noting that it remains strong despite some slowing. He pointed out that the 4.1% unemployment rate is close to full employment, and job growth remains robust at 254,000 new jobs in September. Bostic indicated that job growth below 100,000 per month might prompt faster rate cuts. However, he emphasized that inflation, currently at 2.6%, is still too high and reiterated his focus on reaching the 2% target. His comments suggest a cautious approach to rate cuts, balancing labor market strength with inflation concerns.

- Susan Collins: Emphasized that further interest rate cuts are likely needed to preserve the U.S. economy. She reiterated the Fed’s data-dependent approach and noted the labor market’s current favorable position.

- Philip Jefferson: Gave a detailed history of the Fed’s discount window from 1913 to 2000 and discussed the current request for public feedback on discount window operations.

Overall, the speeches suggest a cautious openness to further rate cuts, with most Fed officials emphasizing the importance of monitoring economic data and maintaining a balanced approach between controlling inflation and supporting employment – you know – gobbledygook…

Still, there was strong demand (2.45 bid/cover) for the 3-year notes yesterday at 3.878%, which is well below the Fed’s Current Discount Rate of 4.875% – indicating the Fed does still have room to cut. We’ll find out more at 2pm and that’s right in the middle of today’s Live Trading Webinar – where we’ll be discussing THE HURRICANE, our $700/Month Portfolio and the Fed Minutes – you can join us HERE at 1pm, EST!

Speaking of hurricanes – 5.5M people in Florida are being evacuated from what is currently a Category 5 Hurricane, with sustained winds of 160 mph or, what Elon Musk calls “Ludicrous Speed!” NHC specialist John Cangialosi warns that “Milton has the potential to be one of the most destructive hurricanes on record for west-central Florida.” Milton’s center is predicted to make landfall somewhere along the coast between Tarpon Springs and Cape Coral, according to the hurricane center’s official forecast.

Especially in Northern Florida, which still has debris from the last storm all over the place – keep in mind that a major league fastball is 100 mph so you REALLY don’t want to be outside in a 160 mph storm – with cows and such flying at you.

Especially in Northern Florida, which still has debris from the last storm all over the place – keep in mind that a major league fastball is 100 mph so you REALLY don’t want to be outside in a 160 mph storm – with cows and such flying at you.

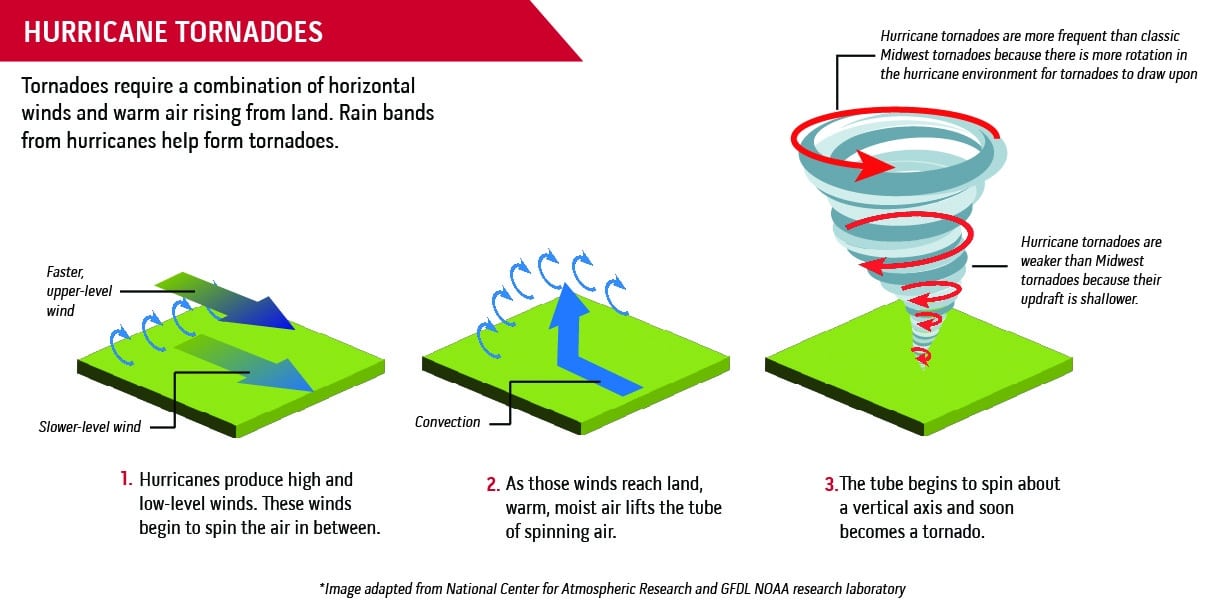

And yes, Hurricanes cause tornadoes and those can be nasty on their own and they can occur far outside the hurricane zone as it tends to strongly agitate the skies and waters hundreds of miles outside the zone. In fact, in 2005, Hurricane Katrina, in Louisiana, caused tornadoes as far away as Pennsylvania, a thousand miles away from where the storm made landfall…

It will be interesting to see if

IN PROGRESS