- Dogecoin price bounced 13% higher to reclaim territory above $0.40 on Friday, snapping a weeklong consolidation phase.

- DOGE traders deployed $355 million on leveraged long positions following Gary Gensler’s exit confirmation.

- DOGE price trading 3% above its Volume Weighted Average Price (VWAP) suggests another breakout could follow.

Dogecoin price crossed $0.40 on Friday, after a weeklong consolidation that saw DOGE tumble 13% from last week’s peak. Derivative market reports link the DOGE rally to Gary Gensler’s imminent exit.

Dogecoin reclaims $0.40 as markets react to Gensler’s exit

Elon Musk’s involvement in the proposed Department of Government Efficiency (D.O.G.E) under the incoming Trump administration drove Dogecoin price to a three-year peak on November 12. But since then, DOGE slipped into a 10-day long consolidation phase as traders began taking profits.

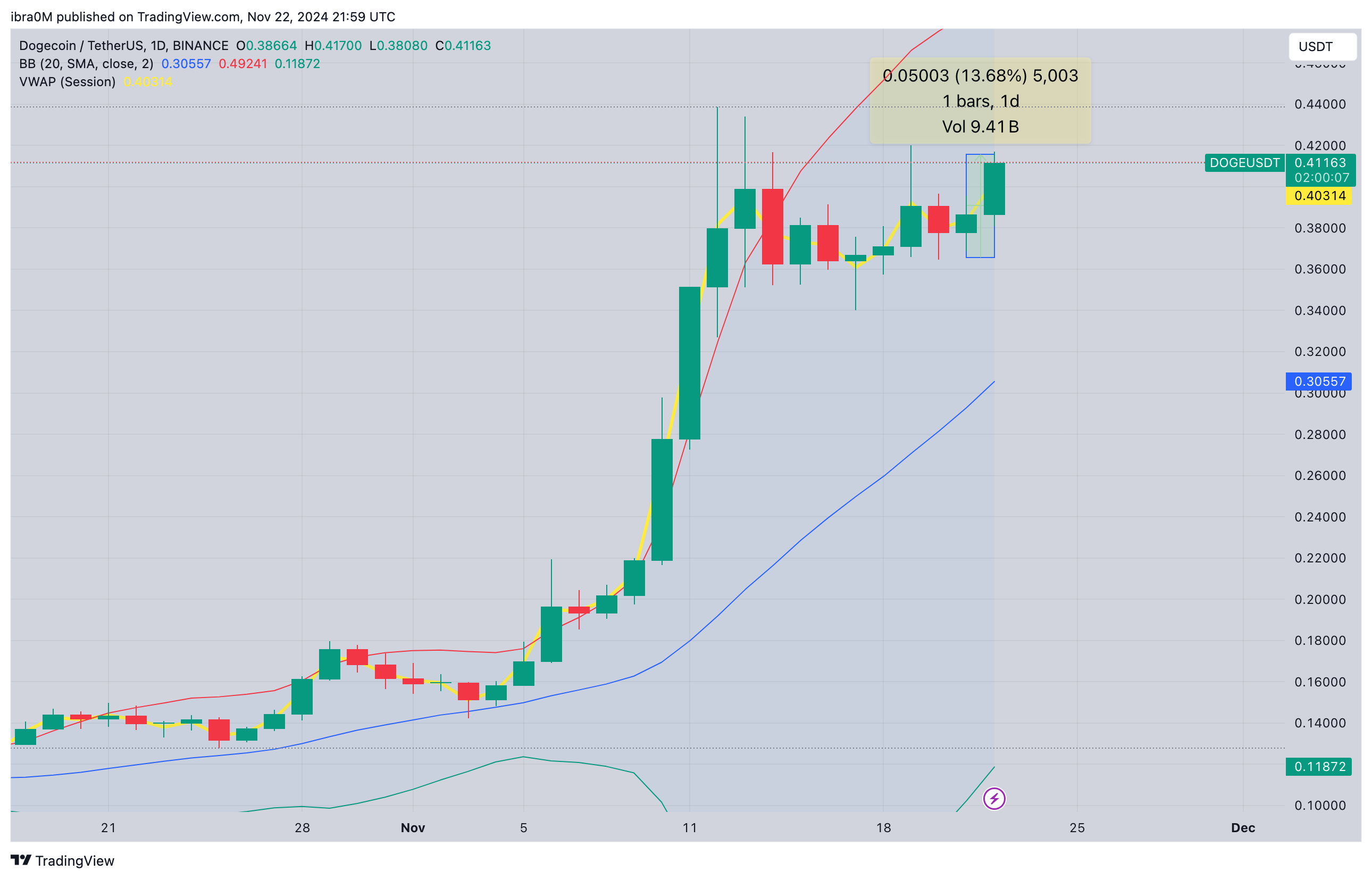

The chart above depicts how DOGE price surged 185% between November 5 and November 12, before succumbing to a 13% dip in the subsequent ten days.

When DOGE price opened trading at $0.38 on November 21, it reflected a 13% dip from the three-year peak of $0.44 recorded when Trump confirmed the D.O.G.E. formation on November 12.

However, on Thursday, news reports revealed that the head of the US Securities & Exchange Commission (SEC), Chair Gary Gensler, is set to step down from his position on January 20.

Crypto enthusiasts reacted to the news positively as it signals an end to a controversial regime fraught by intense scrutiny and litigation against several crypto firms and high-profile personalities.

Within 24 hours of the announcement, the global crypto market rose to new all-time highs above $3.25 trillion, lifting top ranked coins including Dogecoin, XRP and Cardano into double-digit gains. At the time of writing on November 22, DOGE price has moved above the $0.42 level, signaling 13% gains in the last 24 hours.

Bulls mount $355 in long positions to capitalize on positive market sentiment

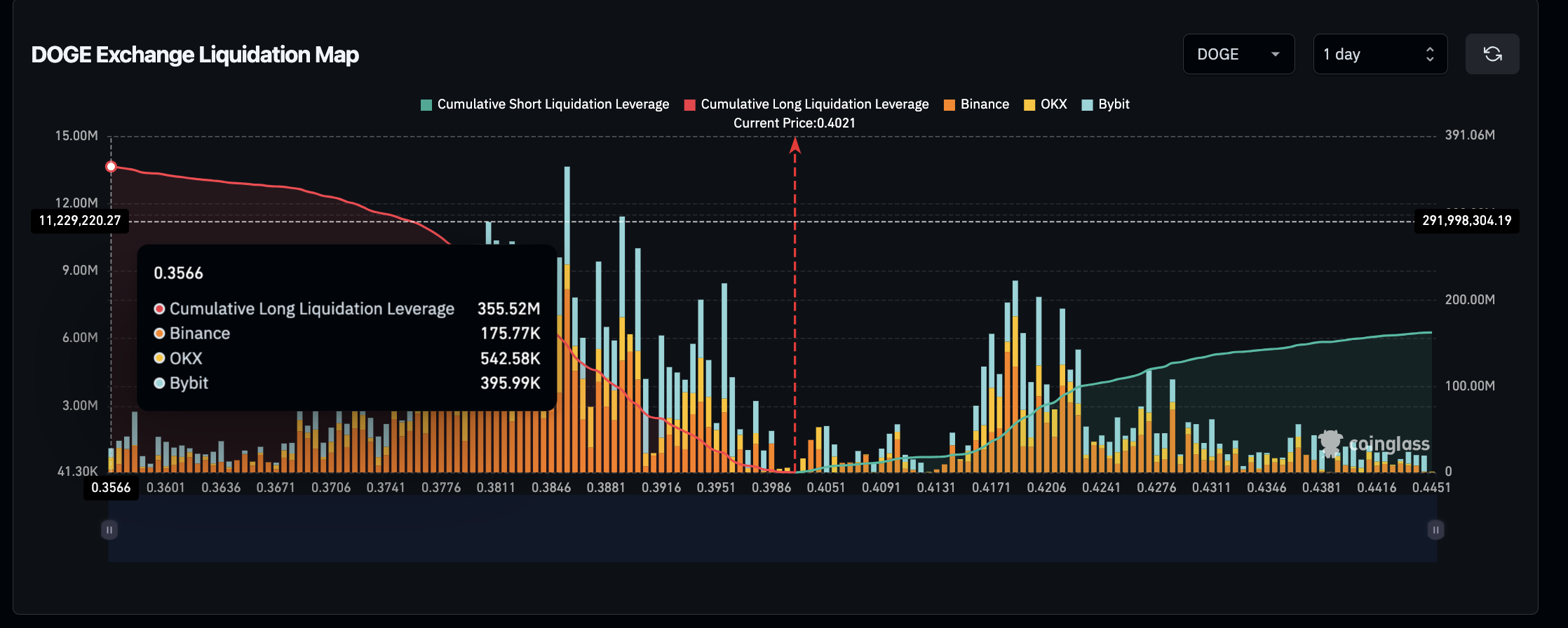

As DOGE price moved above the vital $0.40 resistance on Friday, bullish traders have gained a foothold in the derivatives markets. Confirming this narrative, the volume of leverage deployed on Dogecoin futures contracts in the last 24 hours far exceeded the shorts, a move that often predicts major price breakouts.

The Coinglass liquidation map chart below shows the real-time balances of long and short leverage contracts deployed around the current ADA prices.

Cardano liquidation map | Source: Coinglass

The long leverage positions on Dogecoin (DOGE) reached $355.5 million, while short contracts stood at $162.6 million on Friday. With longs exceeding shorts by approximately $192.9 million, this demonstrates 118.7% higher capital deployed on the bullish side. This suggests that Dogecoin bulls have gained short-term dominance in the derivatives markets.

When long leverage positions outpace shorts by such a significant margin, it usually signals two key bullish indicators:

- Increased Market Confidence:

Higher long positions indicate that traders are optimistic about Dogecoin’s short-term price trajectory. If DOGE bulls support their highly-leveraged positions with rapid spot purchases, it could amplify upward price volatility.

- Potential Short Squeezes:

When shorts are overwhelmed by bullish leverage, any upward price movement can trigger stop-losses on short positions, forcing them to close and buy back DOGE. This cascading effect could potentially drive Dogecoin prices higher in the days ahead.

Dogecoin price forecast: $0.45 breakout could trigger larger gains

If Dogecoin sustains this bullish leverage imbalance while maintaining key support levels, it could propel prices toward higher resistance targets around $0.45.

Confirming this bullish forecast, the widening Bollinger Band indicators signal rising volumes and volatility, emphasizing the likelihood of a $0.45 retest.

More so, DOGE price is currently trading above its Volume Weighted Average Price (VWAP) at $0.40. If DOGE closes above this key support level amid positive speculative pressure, a breakout toward $0.45 could be on the cards.

Dogecoin price forecast | DOGEUSDT

Dogecoin price forecast | DOGEUSDT However, traders should remain cautious, as excessive leverage can lead to sharp corrections if the market reverses.

In such a scenario, if the bulls fail to hold the $0.40 support, rapid long liquidations could trigger a breakdown toward the 20-day Simple Moving Average (SMA) at $0.31.