AUD/USD News and Analysis

Recommended by Richard Snow

Get Your Free AUD Forecast

Relentless AUD/USD Selling Continues into the new Week

New week, same vulnerabilities for Aussie longs. The Aussie dollar had previously enjoyed a period of appreciation as the RBA talked tough on inflation, even considering rate hikes at the recent meeting, while US inflation has edged lower still – prompting renewed rate hike expectations from the Fed as soon as September.

However, since breaching oversold territory on the 12th of July as seen via the RSI, AUD/USD has experienced a consistent decline. While the effect of profit taking cannot be dismissed, it would appear that politics and a lower S&P 500 are weighing on the Aussie dollar right now. The rise in US polls concerning a Trump presidency has heightened the risk of further trade wars and restrictions on China – something that typically works to the detriment of the Aussie dollar as it is heavily reliant on Australia as its main trading partner.

AUD/USD Daily Chart

Source: TradingView, prepared by Richard Snow

AUD/USD now tests the 0.6644 level which restricted bullish price action between March and May this year, with 0.6580 (April 2020) the next level to consider. Such an aggressive and immediate selloff may ease this week especially when considering US PCE is due later this week and could continue to reveal further progress in the battle against inflation (lower PCE may lead to a softer dollar). While its tough to argue against the current, short-term bearish trend, the 200-day simple moving average coincides with the 0.6580 level in what could be seen as the biggest test for AUD/USD bears to advance a pullback attempt.

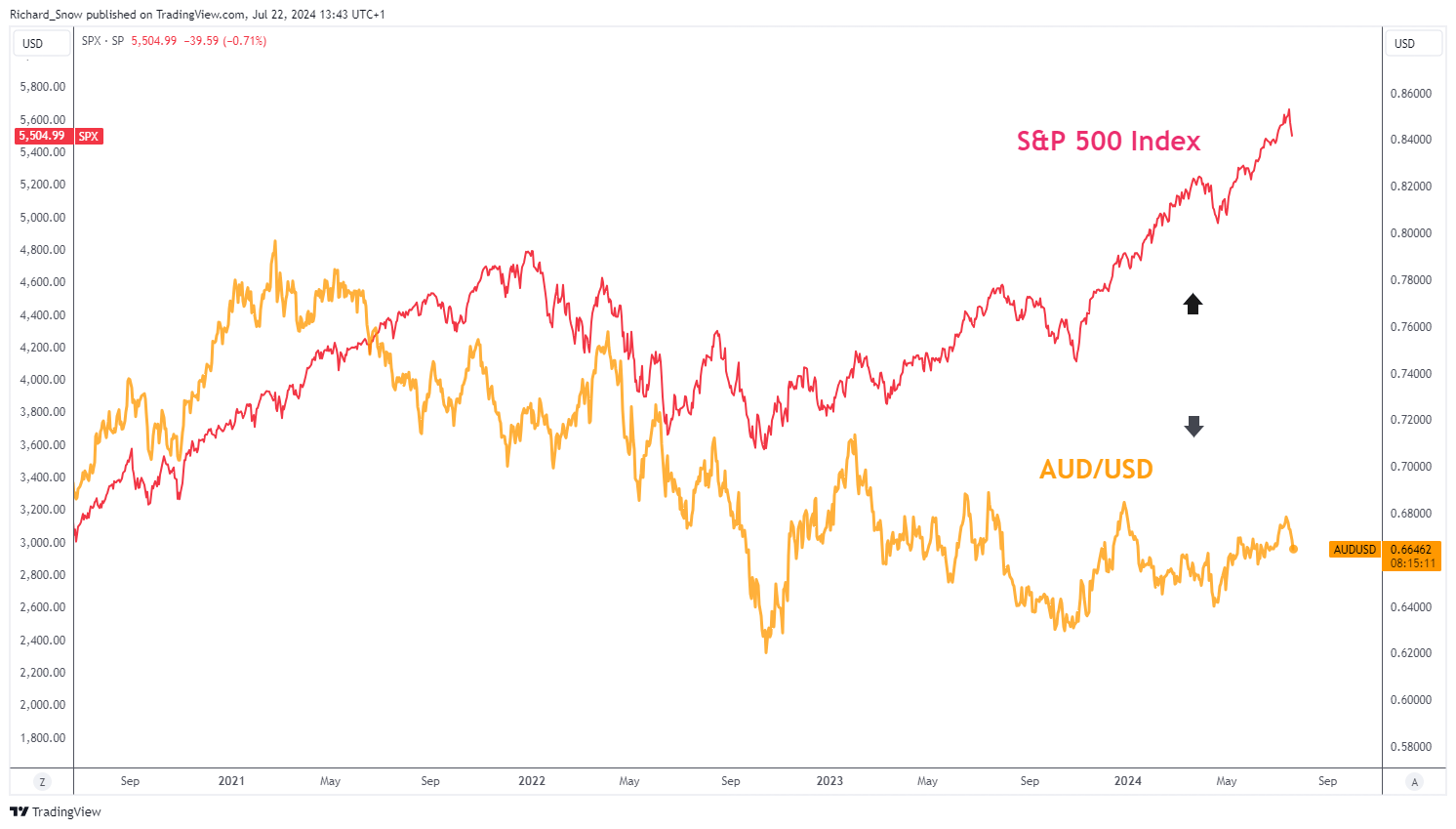

The Australian dollar typically exhibits a positive correlation to the S&P 500 index as the two risk assets have risen and fallen in similar fashion in the past. However, the correlation has not been as clear in recent times, as the two have actually diverged as the S&P 500 continued to soar.

Both the Aussie dollar and P&P 500 Index closed lower last week, with the Aussie adding to those declines on Monday, while S&P futures point to a higher open.

AUD/USD Correlation Weakening

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade AUD/USD

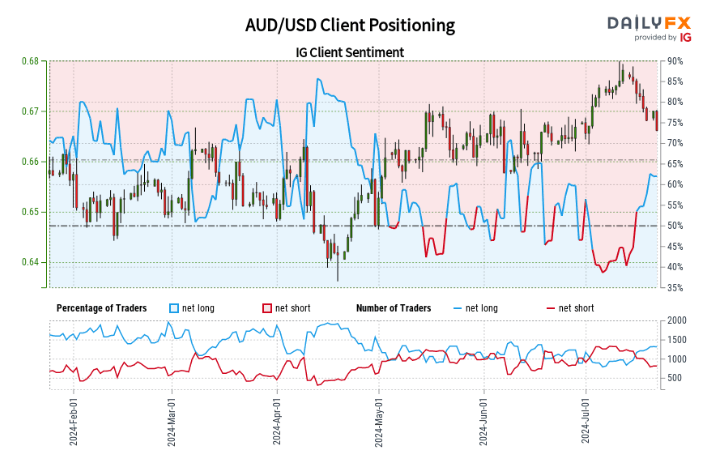

AUD/USD Sentiment: Significant Shift Towards Long Positioning Warrants Attention

Recent retail trader data reveals a sizeable imbalance in market positioning. Currently, 64.57{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} of traders hold long positions, resulting in a long-to-short ratio of 1.82 to 1.

Notable shifts in trader sentiment have occurred:

- Net-long positions: Up 10.21{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} since yesterday, 57.97{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} increase from last week

- Net-short positions: Down 5.36{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} since yesterday, 37.63{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} decrease from last week

Source: DailyFX, IG, prepared by Richard Snow

Our analysis typically adopts a contrarian approach to crowd sentiment. The current net-long positioning suggests potential downward pressure on AUD/USD prices.

Given the increasing net-long sentiment compared to both yesterday and last week, combined with recent market dynamics, our outlook indicates a bearish bias for AUD/USD when viewed from a contrarian perspective.

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX