Below are five exchange traded funds which, unlike those I’m including in my “Hercules” post this weekend, seem to be at the cusp of resuming their downtrends, now that the “Jensen Huang says things are good” mega-rally is over. We have the emerging markets:

Relatedly, we have Brazil, which has a well-formed top in pink and whose country fund will be at the mercy of crude oil and, thus, PBR, its main component.

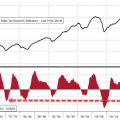

The tech stocks had a huge bounce, particularly on Wednesday, but the series of lower lows is still intact, and those two dashed red lines present formidable resistance levels.

The same holds true for the semiconductor sector, which is largely at the mercy of Nvidia (and, more specifically, whatever pump-and-dump nonsense comes out of Jensen Huang’s piehole).

One item which is particularly opaque to me right now is the small caps. On the one hand, they have shown the same series of lower highs over the past couple of months. On the other hand, this financial instrument has been executed a longer-term series of lower highs and lower lows since the bottom eleven months ago (which, amazingly, which in the same price vicinity as the low in October 2022). We need to break the low we saw a week ago in order to stop this pattern.

ETF Focus: Countertrend