– by New Deal democrat

Angry Bear PM Take: It would seem like Fed Chair Powell feels good about the progress.

The theme of the JOLTS report for June was “continued deceleration,” but no particular cause for concern. As we’ll see below, that’s because the “bad” metrics declined just as much as the “good” ones did.

To start with, job openings (blue in the graph below), a soft statistic that is polluted by imaginary, permanent, and trolling listings, declined -46,000, or -0.6{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} from an upwardly revised May reading to 8.184 million (vs. a pre-pandemic peak of 7.594 million). Actual hires (red) declined -314,000, or -5.6{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} to a new post-pandemic low of 5.341 million (vs. a pre-pandemic peak of 6.0 million). Voluntary quits (gold) declined -121,000, or -3.6{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} from downwardly revised near-post 2020 lows in April 3.282 million, the lowest rate in three years. The last two, as you can see In the below graph below, are sharp declines. Note all values are normed to a level of 100 as of just before the pandemic:

Hires are now down -10.9{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} from their level just before the pandemic and quits are down -5.2{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38}.

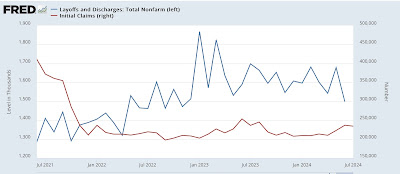

But the reason this month’s air-pocket isn’t particularly concerning is that the exact same thing happened with layoffs and discharges (blue in the graph below), which declined -180,000, or -10.7{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} (!) to 1.654 million, their lowest level since late 2022, and roughly 25{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} below their typical level in the 10 years before the pandemic:

The more leading weekly initial jobless claims (red), which have increased signficantly in the past several months, suggest that layoffs and discharges may increase as well, although the former have probably been affected by unresolved seasonality, so take this with an extra grain of salt.

Finally, the quits rate for June was unchanged from a -0.1{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} downwardly revised May at 2.1{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38}, again a post-pandemic low. As I have noted for a number of months now, the quits rate (blue in the graph below) tends to lead average hourly earnings (red, right scale), this suggests that the deceleration in nominal wage growth may continue also slowly:

My big concern over the past year has been if a further deceleration in wage growth were to coincide with an upturn in inflation, because that would likely cause a decline in real consumer income and spending. If both are abating, then the net impact remains a positive for the economy.

AB: I believe it was the 1970s when we were experiencing high inflation and unemployment. Some terrible times.

About the April JOLTS report: hiring and quitting remain very, very good, Angry Bear, by New Deal democrat