Euro (EUR/USD) Latest – German Economic Outlook Slumps in August

Recommended by Nick Cawley

Get Your Free EUR Forecast

The economic outlook for Germany is breaking down, according to the latest ZEW survey, showing ‘the strongest decline of the economic expectations over the past two years.’ According to today’s report,

‘It is likely that economic expectations are still affected by high uncertainty, which is driven by ambiguous monetary policy, disappointing business data from the US economy and growing concerns over an escalation of the conflict in the Middle East. Most recently, this uncertainty expressed itself in turmoil on international stock markets,’ comments ZEW President Professor Achim Wambach, PhD on the survey results.

ZEW Indicator of Economic Sentiment – Expectations Break Down

For all market-moving economic data and events, see the DailyFX Economic Calendar

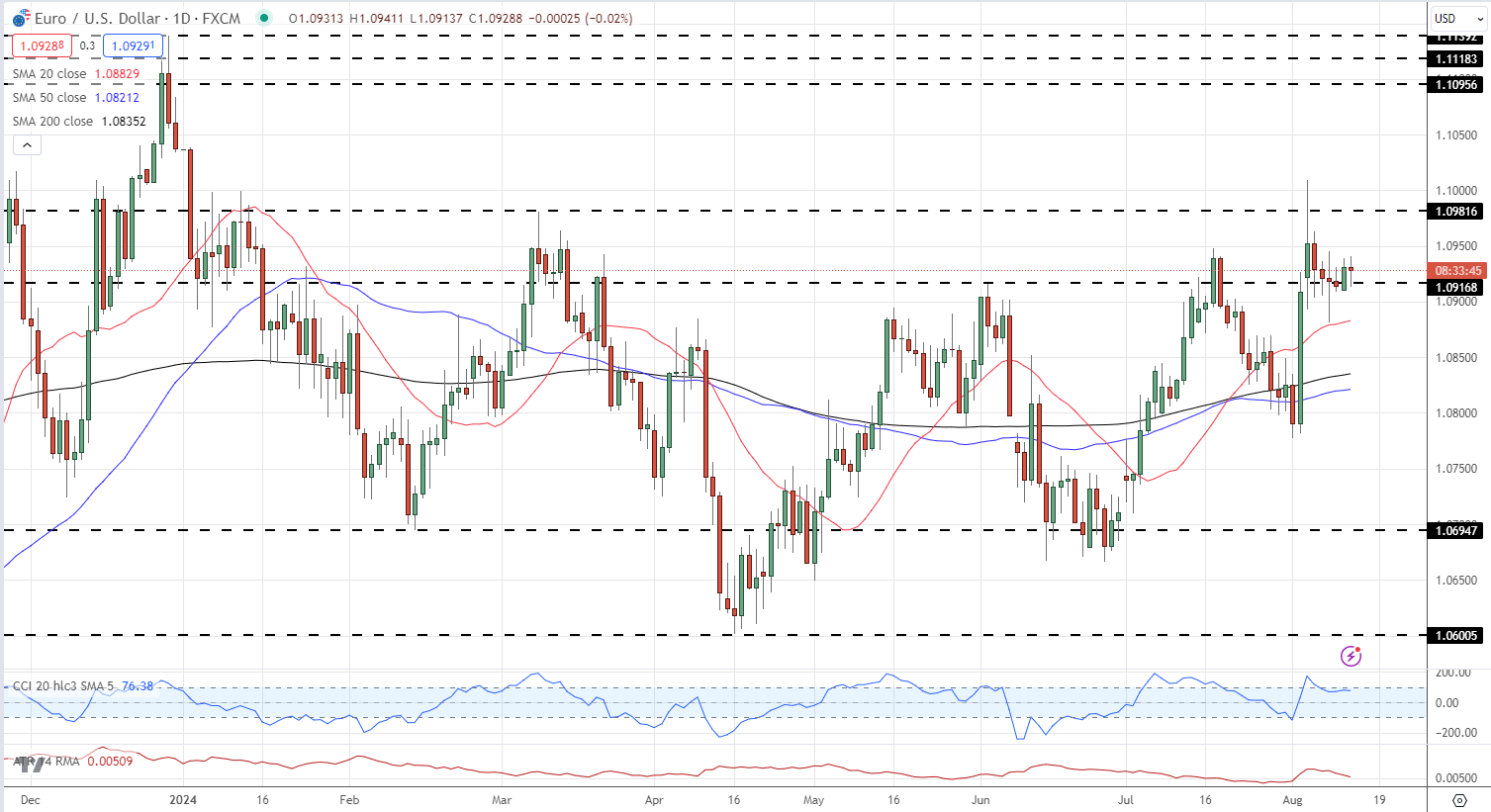

EUR/USD moved marginally lower against the US dollar but remains in a tight, short-term range. Initial support is seen off last Thursday’s low at 1.0881 and the 50-day sma at 1.0883, while initial resistance at 1.0950.

Recommended by Nick Cawley

How to Trade EUR/USD

EUR/USD Daily Price Chart

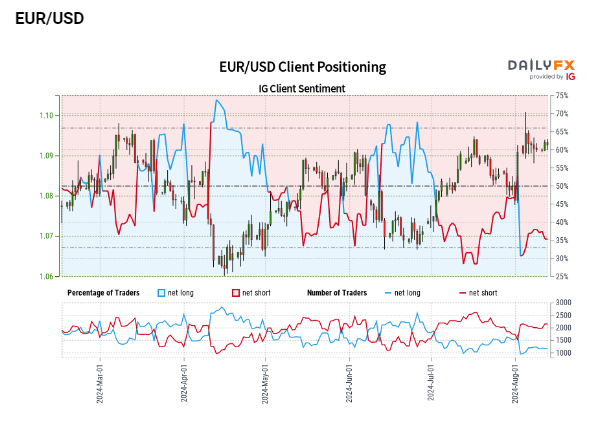

Retail trader data shows 37.51{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} of EUR/USD traders are net-long with the ratio of traders short to long at 1.67 to 1.The number of traders net-long is 2.42{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} higher than yesterday and 14.11{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} higher from last week, while the number of traders net-short is 0.42{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} lower than yesterday and 2.32{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse lower despite the fact traders remain net-short.

| Change in | Longs | Shorts | OI |

| Daily | 1{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} | 0{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} | 0{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} |

| Weekly | 6{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} | 7{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} | 7{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} |

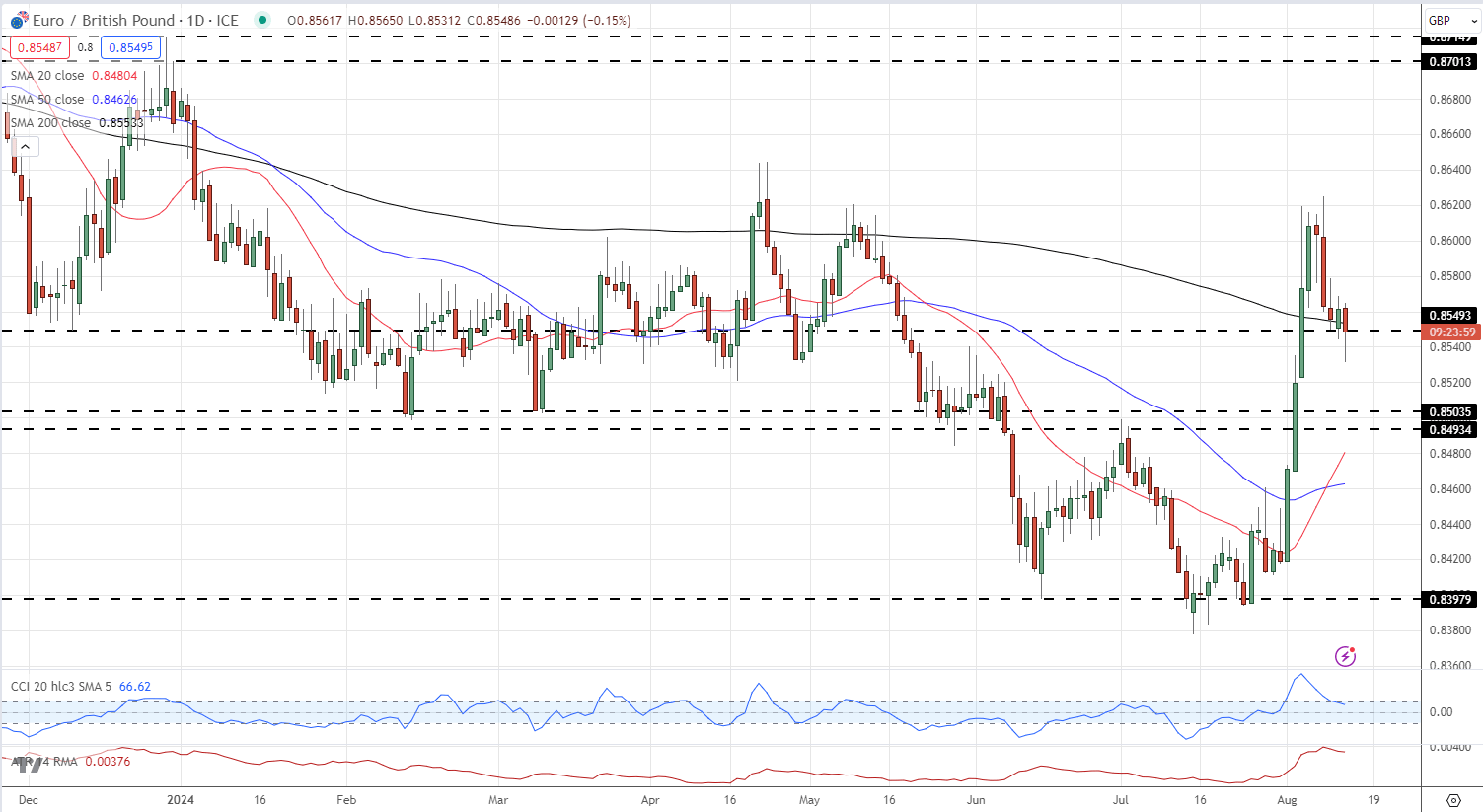

EUR/GBP fell to a fresh one-week low on a combination of Euro weakness and Sterling strength. Earlier today data showed UK unemployment falling unexpectedly – from 4.4{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} to 4.2{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} – dialing back UK rate cut expectations.

UK Unemployment Rate Falls Unexpectedly, Major Concerns Reappear

After making a four-month last week, EUR/GBP has faded lower and is now trading on either side of an old area of importance at 0.8550. Below here 0.8500 comes into focus. Short-term resistance is seen at 0.8580 and 0.8600.

EUR/GBP Daily Chart

Charts using TradingView