Euro (EUR/USD) Unchanged as ECB Leaves Rates Unchanged, September Meeting Now Key

- European Central Bank (ECB) leaves all interest rates unchanged.

- ECB remains data dependent, eyes on September’s staff projections

Recommended by Nick Cawley

Trading Forex News: The Strategy

The European Central Bank left all three key ECB interest rates unchanged today, fully in line with market expectations. The ECB recognised that some measures of underlying inflation ‘ticked up in May’ but added that ‘most measures were either stable or edged down in June.’

For all high-importance data releases and events, see the DailyFX Economic Calendar

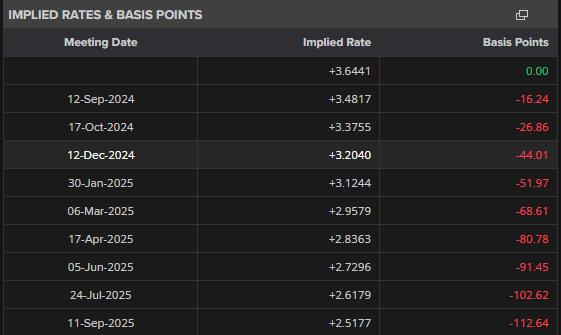

With Europe now approaching their holiday season, the quarterly ECB staff macroeconomics projections at the September 12th meeting will become key. The Euro system and European Central Bank (ECB) staff develop comprehensive macroeconomic projections for both the euro area and the global economy. These projections serve as a crucial input for the ECB Governing Council’s evaluation of economic trends and potential risks to price stability. If these projections show price pressures easing further, and growth remaining tepid, the Governing Council may well green light their second 25 basis point cut. Financial markets are currently pricing in a 65{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} chance of a rate cut in September.

Implied ECB Interest Rates

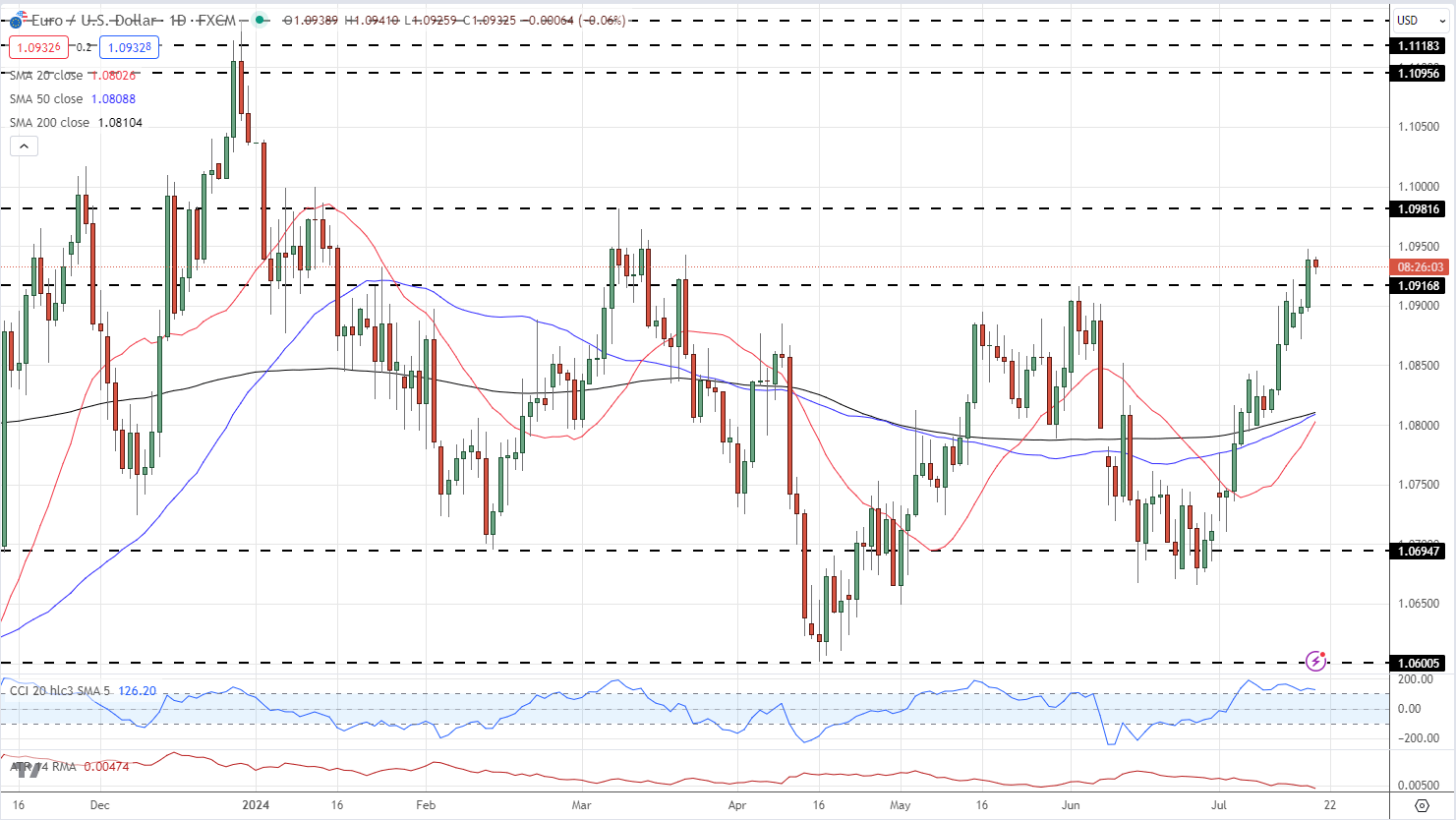

EUR/USD has traded in a very tight range today after rallying higher in recent days on US dollar weakness. EUR/USD is within touching distance of making a fresh multi-month high with the March 8th high at 1.0982 the first target ahead of big figure resistance at 1.1000. With the ECB decision out of the way and the traditional August European holiday season near, EUR/USD will likely be driven by US dollar activity.

Recommended by Nick Cawley

How to Trade EUR/USD

EUR/USD Daily Price Chart

Chart using TradingView

Retail trader data shows 29.62{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} of traders are net-long with the ratio of traders short to long at 2.38 to 1.The number of traders net-long is 4.55{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} higher than yesterday and 19.97{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} lower than last week, while the number of traders net-short is 5.14{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} higher than yesterday and 14.07{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} higher than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

| Change in | Longs | Shorts | OI |

| Daily | 18{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} | -6{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} | 1{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} |

| Weekly | 4{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} | 6{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} | 5{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} |

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.