Gold (XAU/USD) – Latest Sentiment Analysis

Recommended by Nick Cawley

Get Your Free Gold Forecast

The price of gold continues to push higher and is set to test the May 20th all-time high of $2,450/oz. Renewed speculation that the Federal Reserve will cut rates by 25 basis points in mid-September is helping the latest move higher. Financial markets are now pricing in a total of 65 basis points of US rate cuts this year, leaving a third move lower a 50/50 call.

Data using Reuters Eikon

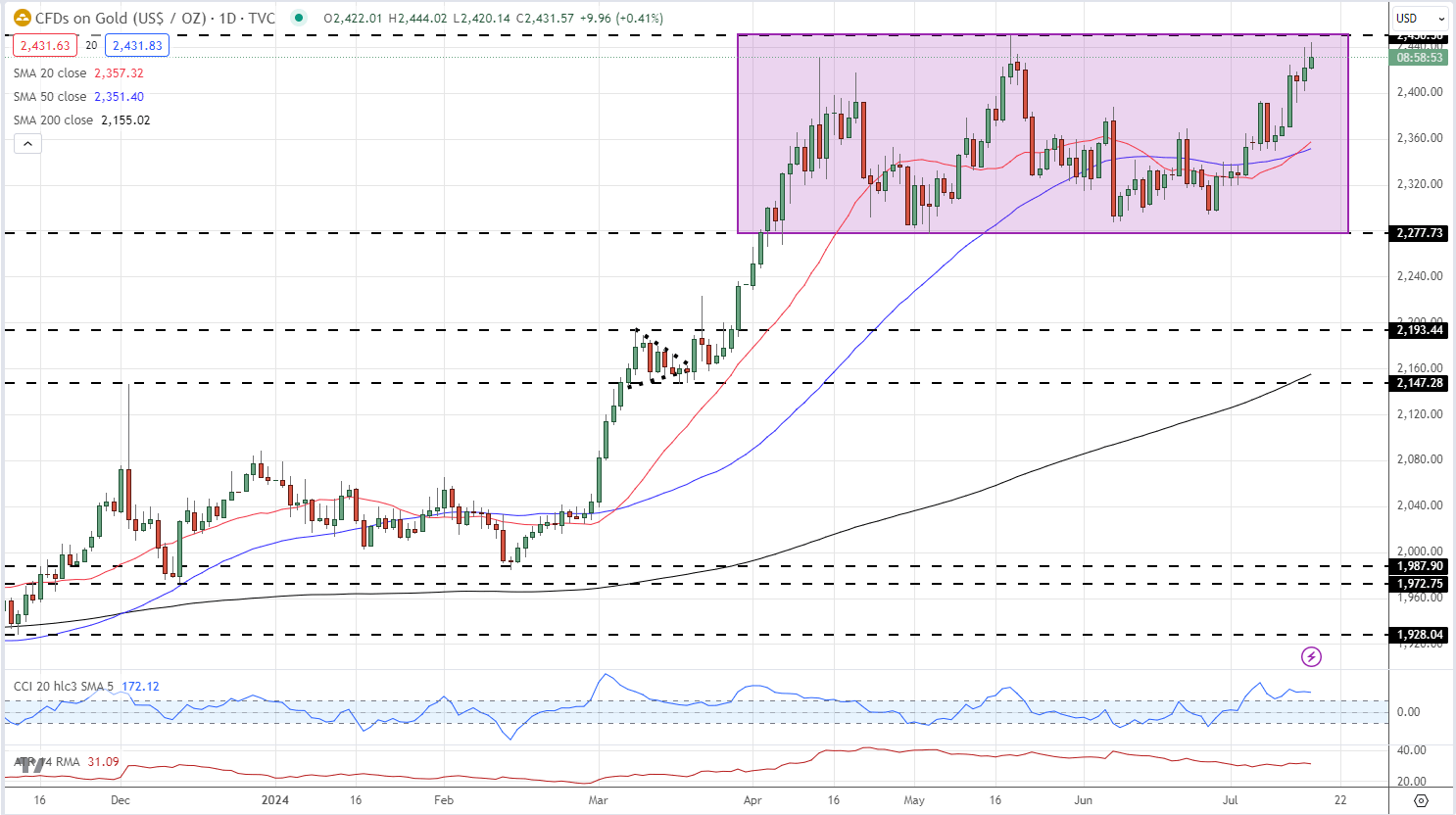

The daily chart shows gold nearing the top of its recent multi-month range with the move supported by the 20- and 50-day simple moving averages. The CCI indicator suggests that gold is overbought, so a short period of consolidation may be seen before fresh highs are made.

Gold Daily Price Chart

Chart via TradingView

Retail trader data shows 49.86{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} of traders are net-long with the ratio of traders short to long at 1.01 to 1.The number of traders net-long is 1.69{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} lower than yesterday and 12.94{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} lower from last week, while the number of traders net-short is 5.27{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} higher than yesterday and 16.85{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests Gold prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Gold-bullish contrarian trading bias.

| Change in | Longs | Shorts | OI |

| Daily | -4{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} | 6{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} | 1{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} |

| Weekly | -17{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} | 25{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} | 1{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} |

What is your view on Gold – bullish or bearish?? You can let us know via the form at the end of this piece or contact the author via Twitter @nickcawley1.