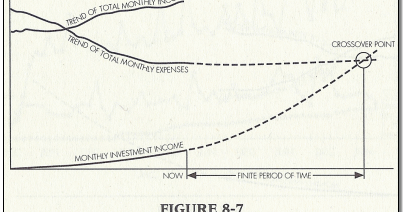

The goal of every Dividend Growth Investor is to generate enough dividends to pay for their retirement. It takes patience, persistence and perseverance to accumulate that income producing nest egg. But once it is built, and that dividend income covers expenses at the dividend crossover point, work becomes optional.

The neat thing about dividend income is that it has historically increased faster than inflation in the US. While individual companies in a portfolio may cut dividends, the overall portfolio continues to generate more dividends overall, because more companies increase dividends than cut them.

Dividend Growth Stocks are not just limited to the Dividend Aristocrats, Dividend Kings, Dividend Champions and Dividend Achievers either. I have long claimed that the entire US Stock Market is basically one giant Dividend Growth Stock.

A reader of the blog recently shared an interesting chart with me. He calculated how a $1 Million investment in S&P 500 at the end of 1993 would have done for a retiree.

The assumption is that the retiree invested $1 Million in S&P 500 fund at the end of 1993. It follows the dividend amounts per year and provides two comparisons. The first scenario is that the dividends are spent. The second scenario basically shows how the portfolio would have grown to, if somehow dividends were not spent but rather reinvested.

While it doesn’t take into consideration fees, taxes, and commissions, it is never the less a very interesting review. On the other hand, it is quite possible (and has been in the past) to build a portfolio in a retirement account such as an IRA or 401 (k), and defer taxes.

(Source)

Around the years that dividend income declined, share prices actually declined by much more.

It’s fascinating how dividend income kept increasing year in and year out over the past 30 years, ultimately increasing by a factor of 5 by 2023 from the initial year.

At the same time, the value of the portfolio increased by a factor of 10. This means that the original $1 Million investment at the end of 1993 turned to a little over $10 million by end of 2023. Or $10,225,812 to be exact.

Had the investor not spent their dividends however, they would have ended up with $18,176,399.

On a side note, the reader has a very interesting valuation ratio on the very right of the chart above. It shows how much one needs to invest in S&P 500 in order to get $1 worth of dividends. In effect, it is an inverse dividend yield calculation. For example paying $25 for $1 of dividend income translates into a dividend yield of 4{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38}. You want to pay less for each dollar of dividends in general, all else being equal.

You can note that over the past 30 years, dividend yields on S&P 500 has generally declined by basically half. That means that it takes roughly twice as much capital today as in 1993 to generate the same $30,000 in annual dividends. That’s mostly because the dividend yield on S&P 500 today is roughly 1.50{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} versus roughly 3{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} in 1993.

The reason for that decline is because a lot of companies these days pay dividends and also spend much more money on share buybacks. One way to generate that 3{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} starting yield on investments is through a focus on dividend paying companies. Of course, one also needs to avoid the temptation to chase yield as well. However, many popular dividend ETF’s such as the Schwab Dividend 100 (SCHD) yield over 3{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} today, and have a history of growing dividends. I am actually a firm believer that it is possible to pick and choose my own individual companies in my portfolio, in order to achieve my desired goals and objectives.

Either way, living off dividends in retirement can work well for investors. The chart above shows one example of how it worked in the past, with pretty decent results.

Thank you for reading!

Relevant Articles: