Up nicely.

Up nicely.

We won’t get to the LTP until Thursday (hopefully!) but it’s up just about 400% ($2.5M), which is very nice for 17 months and the STP is done and it’s “only” up 120% in the same 17 months, so $441,710 at the moment (8am) and that’s getting very close to 3M and that’s too many Dr. Evils and the market is toppy so – should we shut down? We started with $200,000 in the STP and $700,000 in the LTP so we’re up $2.1M (300%) overall in 17 months and you KNOW that’s not sustainable – so why risk it?

It does depend on your risk tolerance but, if $3M is a lot of money to you – then PLEASE do not leave it all on the table. At least get 1/2 out and let the CASH!!! protect you in the event of a pullback. We may keep going up but you’ll still end up with 75% of the potential gains – while avoiding 50% of the potential losses should the market pull back.

In fact, the first thing we’re going to do here in the STP is spend money to help lock in the LTP gains. I’m NOT going to cash out the portfolios because I don’t feel that strongly that we’re going to pull back (yet!) but I do strongly feel that that is not an appropriate risk for people who have more than 50% of their assets in the market right now. For those people – I strongly suggest taking half off the table and ABSOLUTELY we will find more things to trade – during and after the current Earnings Season.

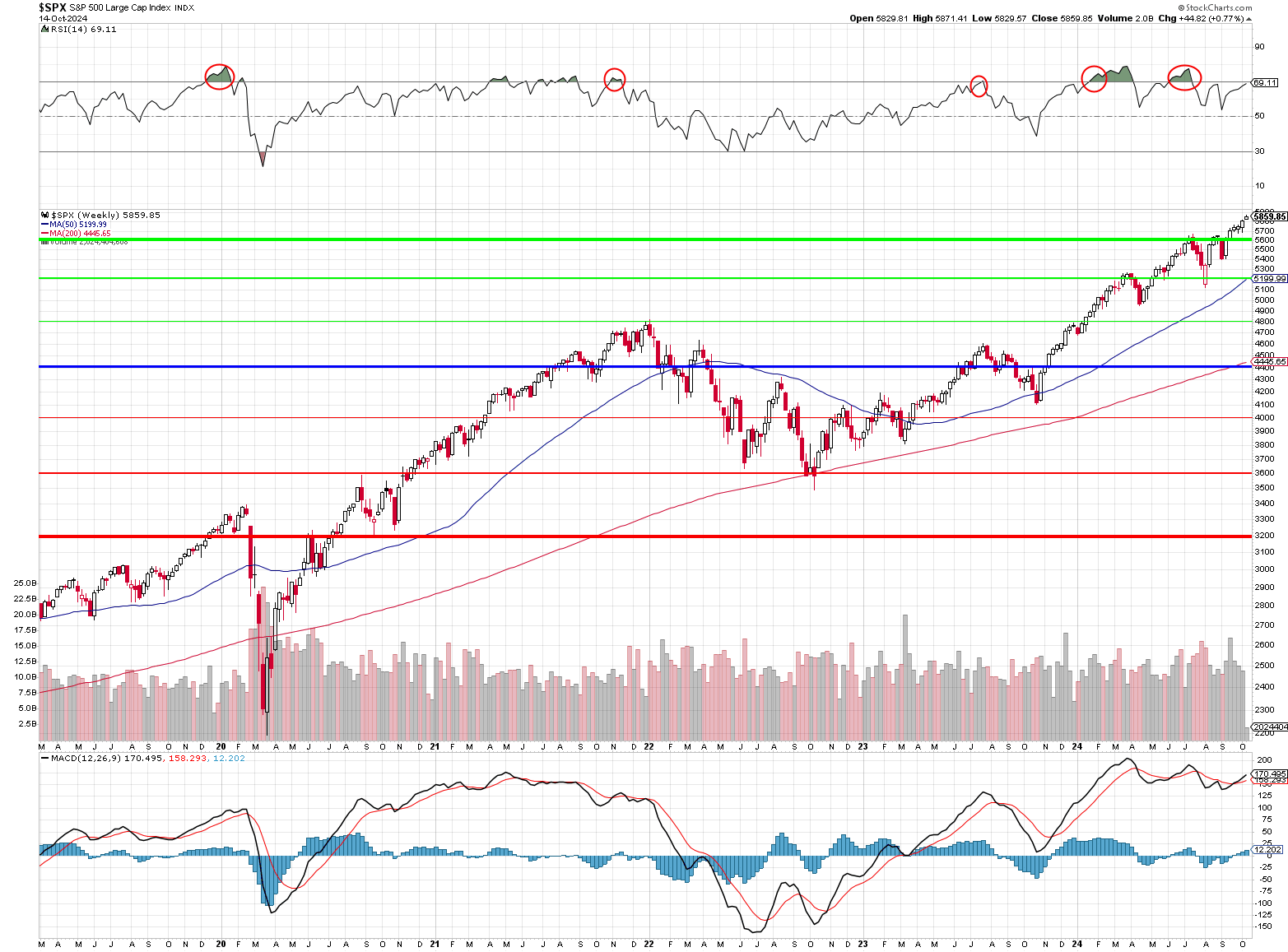

Meanwhile, in our September 17th Review, we left the S&P at 5,633 and the LTP/STP paired portfolios were at $2,746,604. Now we’re at 5,859 and that’s up 226 points (4%) for the month and, as you can see – we’ve punched over the projected top of our range at 5,600 and, as I noted yesterday, we’re now at 26.3x forward earnings on the S&P and that’s 63% higher than the “normal” 16x the S&P trades at. Something has to give!

That RSI line is back to 69.11 and 70 is the danger zone on that index and look at MACD – also pushing it’s limits. Will Q3 earnings be so spectacular and Q4 guidance be so giddy that we’ll ignore all these warning signs and keep barreling ahead towards 40x earnings OR will even the tiniest bump in the road send us hurtling off the valuation cliff we’re approaching like Thelma and Louise?

That RSI line is back to 69.11 and 70 is the danger zone on that index and look at MACD – also pushing it’s limits. Will Q3 earnings be so spectacular and Q4 guidance be so giddy that we’ll ignore all these warning signs and keep barreling ahead towards 40x earnings OR will even the tiniest bump in the road send us hurtling off the valuation cliff we’re approaching like Thelma and Louise?

With that in mind, let’s take a look at our Portfolios:

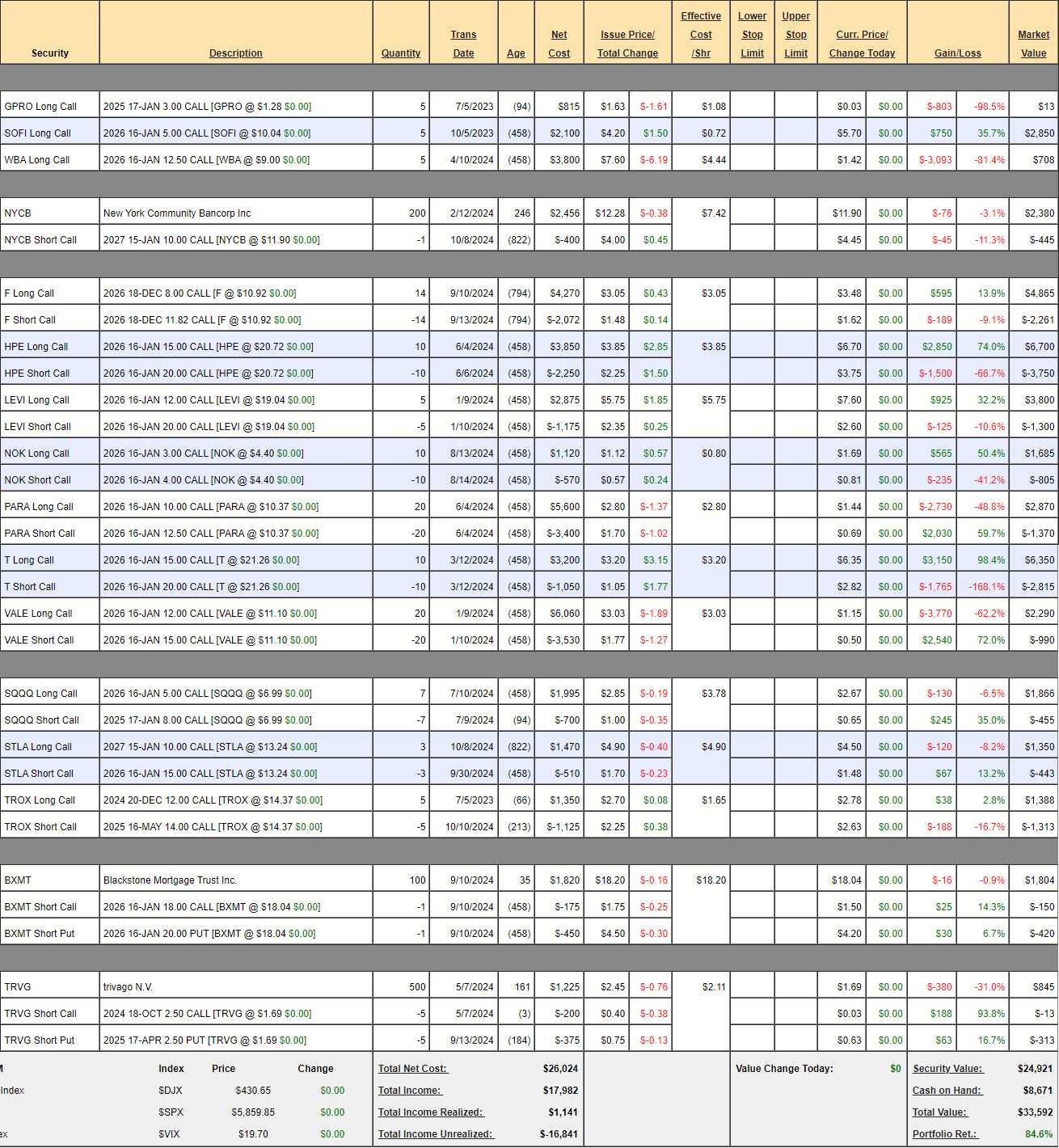

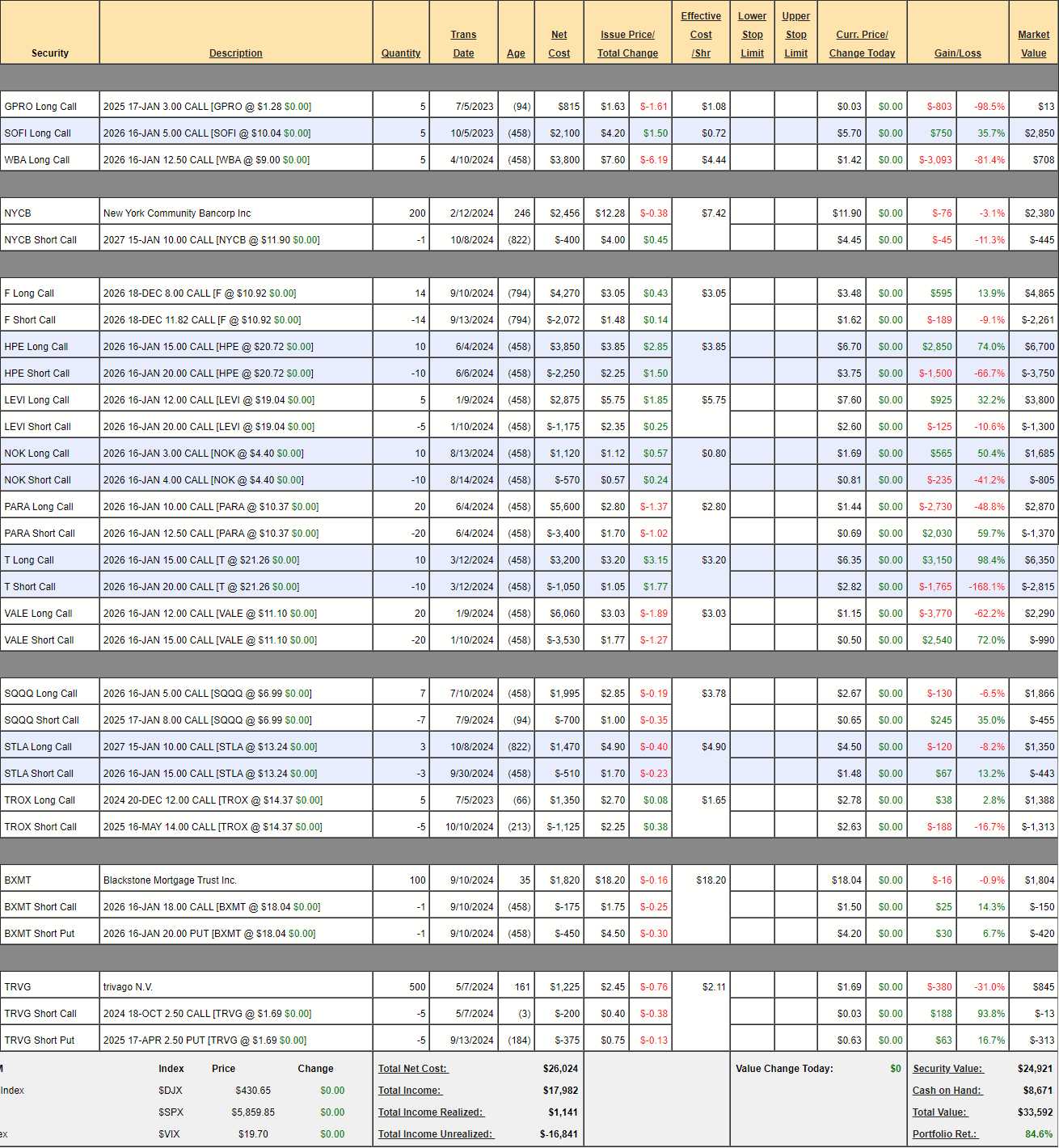

$700/Month Portfolio Review: $33,592 is up 84.6% overall in month 26 and we’re up $769 (2.3%) since last Tuesday’s review so it’s very nice when we add $700+ in a week, isn’t it? We’re not going to review it again so soon but do read last week’s review if you want to learn some good trading lessons (as well as our AI analysis in the Member Chat Room).

At $33,592, we are on track to hit $1M in 10 years so, even if you missed the first 84.6% of our gains – you can start right now and catch the next $966,408 (2,870%) – and that’s pretty good too!

Money Talk Portfolio Review:

IN PROGRESS