“Davidson” submits:

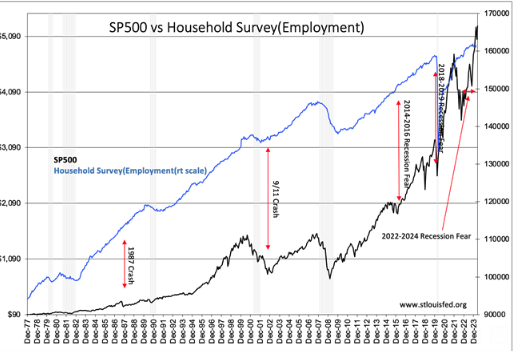

Many consider the PMI a key economic indicator. It is not. It correlates with market psychology and market prices not economics. The history from 1977 shows clearly that dips in the SP500 are highly correlated with PMI (Manufacturing) declines below the —50 benchmark level. But, the PMI has declined below its benchmark roughly three times (3x) more than there have been actual recessions which makes this more like the shepherd boy crying wolf when he feared one rather than seeing one. For comparison, the SP500 vs Household Employment shows that during an economic cycle there are many times investors fear recessions for one reason or another and they do not emerge. There are several Red Arrows in this chart to identify only a few of the periods fears rose without economic significance. To mark all these instances during upcycles that were head-fakes would make this chart unreadable.

In the current cycle, we have had our share of ‘recession-at-the-door’ forecasts, yet employment continues to rise, although at a slowed trend, Real Personal Income continues to rise and Real Retail Sales are holding at elevated levels. The same can be said for Total Construction Spending and Manufacturers New Orders for Durable Goods. The old maxim, “The market rises on a wall of worry” continues to hold true with the SP500 near record highs. One can say the market this time is higher based on recession fears feeding the few issues believed to be safe havens for capital, those 10 or so over-owned high tech issues making up 25{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38}-30{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} of the SP500. CNBC referred to them as the Mag 7. Much of the rest of the SP500 remains discounted to prior investor pricing their financial performance. The heavy over-pricing of a few vs heavy under-pricing of the many makes this a seesaw tipped to extremes and ready to tip back.

The PMI, currently below 50, reflects market pessimism. Nonetheless, we have had many scores of earnings reports better than expected with raised guidance that investors have ignored. These earnings reports are correlated with the uptrends in basic economic indicators. “Wolves are at the door” will give way as the economic indicators trend higher. I thought it would have occurred by now but the recent PMI decline has caused additional concern. For the PMI, it is mind over matter and history shows it takes time for fear to dissipate. In my opinion, the rise in the PMI from its June 2023 low at 46 is telling. The pessimism appears to be easing and the next couple of reports could bring us over 50. That level would trigger an investor shift towards industrial/manufacturing issues that is long overdue.