Yesterday delivered small gains which kept the rally chugging along but there wasn’t much to add on today’s action.

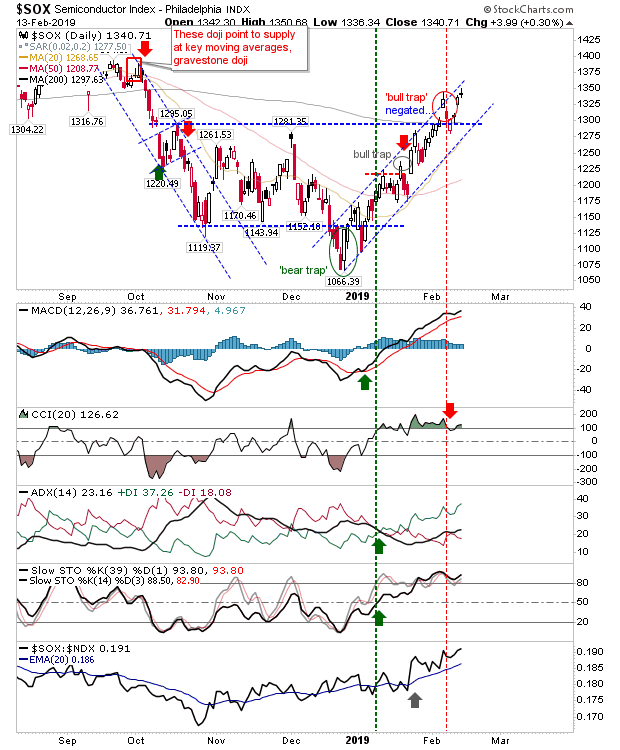

Probably the most important action was the break of the ‘bull trap’ in the Semiconductor Index. The 200-day MA has been comfortably breached and now the index has to work against Fall 2018 supply. This move above the 200-day MA should help the Nasdaq and Nasdaq 100 in their 200-day MA challenges.

The Nasdaq is up against the 200-day MA and will be looking to the Semiconductor Index to help drive a push above the 200-day MA.

Same story for the Nasdaq 100

The Russell 2000 had breached declining resistance yesterday and now it has a bit of room before it runs into resistance at the 200-day MA.

The S&P closed a little bit above over its 200-day MA, but there wasn’t much conviction to the break. On the plus side, there is room to run to resistance which will help existing longs, particularly those who bought the January breakout retest and can now trail stops below the 200-day MA.

For tomorrow, bulls can look to trade a break through the 200-day MAs for the Nasdaq and Nasdaq 100. Existing holders of S&P ETFs/funds can look to a challenge of declining resistance as the upside target. Similarly, traders in Russell 2000 ETFs/funds can play for a move to the 200-day MA. Those of a short persuasion can look to the Nasdaq and Nasdaq 100 for reversals from their 200-day MAs should Thursday’s action start weak.

You’ve now read my opinion, next read Douglas’ blog.

—

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy.

SOURCE: Fallon Financial Commentary – Read entire story here.