Risk Aversion Sets in

- Signs of panic emerge via the VIX and well-known fear gauge

- Japan posts a worrying start to the week for risk assets

- Will the Fed be forced into front-loading the rate cutting cycle?

Recommended by Richard Snow

Get Your Free Equities Forecast

Signs of Panic Emerge via The VIX and a Well-Known Fear Gauge

Fear Gauge Confirms Major Risk Off Move

A well-known measure of risk sentiment in the US is the VIX – which typically rises when the S&P 500 falls to a large degree. The VIX has shot up to levels last seen during the regional bank stress in the US but is still a far way off the peaks of the GFC and Covid crises.

Source: TradingView, prepared by Richard Snow

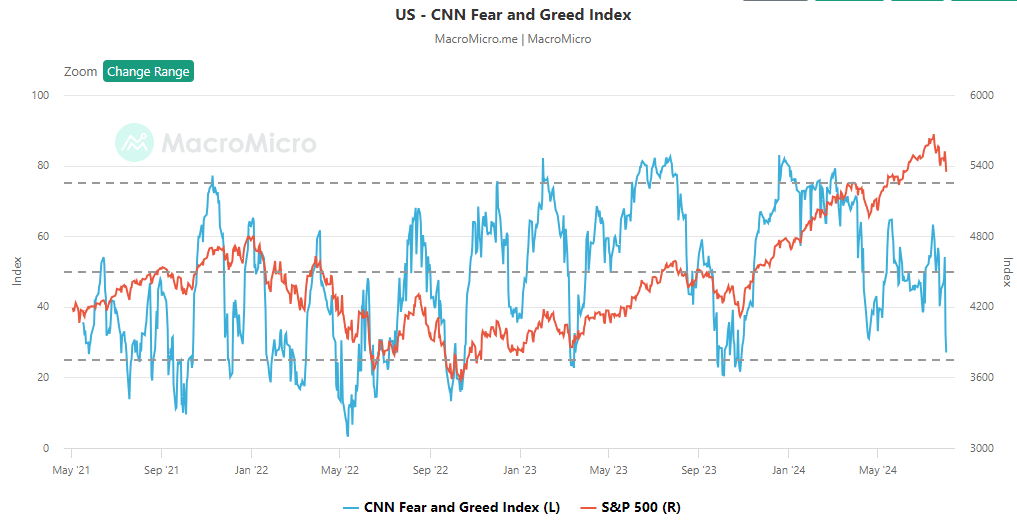

The CNN Fear and Greed Index (blue line) sharply contracted into ‘fear’ territory and borders on ‘extreme fear’ according to a number of metrics it relies upon. This has corresponded with a fall in US equities which shows little sign of slowing down amid a disappointing earnings season so far.

Source: MacroMicro.me, CNN

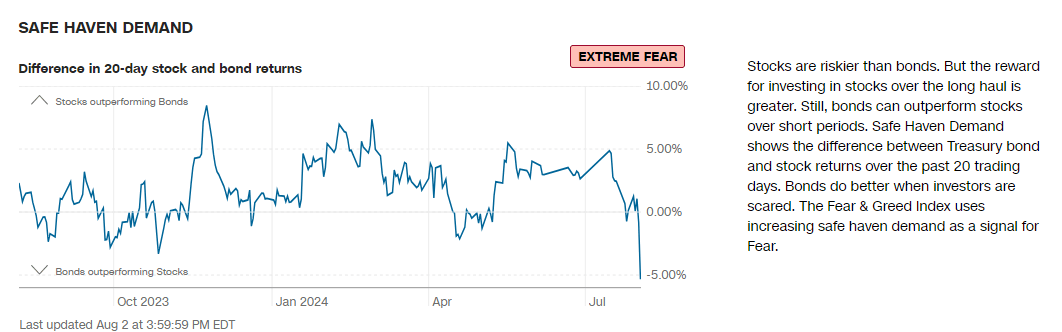

One such metric within the Fear and Greed gauge is the relationship between riskier stocks and safer bonds. The recent sell-off in US equity indices has corresponded to a large rise in bond prices (lower yields). As such the performance of stocks relative to bonds has shot sharply lower, revealing a shift in capital allocation away from risk, towards safety.

Source: CNN Fear and Greed Index, CNN

Japan Posts a Worrying Start to the Week for Risk Assets

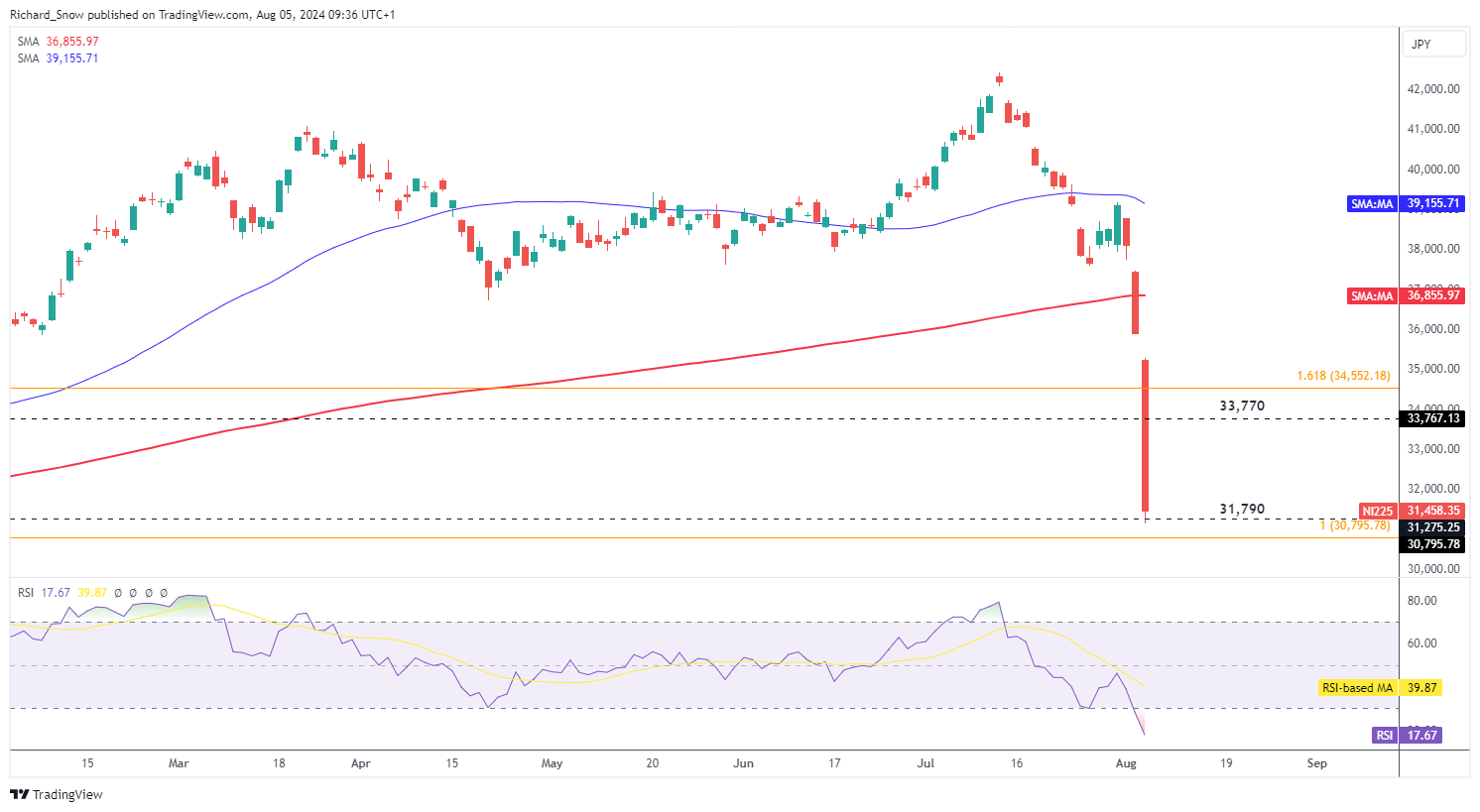

Volatility has arrived and its effects are being felt in Japan on Monday. The Nikkei index plunged more than 12{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} on Monday to register its biggest single day decline since 1987. The index has fallen victim to a rather unfortunate sequence of events.

Expectations of multiple US rate cuts, at a time when the BoJ voted again to hike its policy rate this month has significantly reduced the attractiveness of the popular carry trade. A stronger yen and weaker dollar renders Japanese exporters less attractive and that has helped to extend today’s losses. When the yen was weak, the index rose as exporters enjoyed share price appreciation in expectation of healthy sales numbers. Now the yen is strengthening at a remarkable pace, reversing those prior stock market gains.

Nikkei Daily Chart

Source: TradingView, prepared by Richard Snow

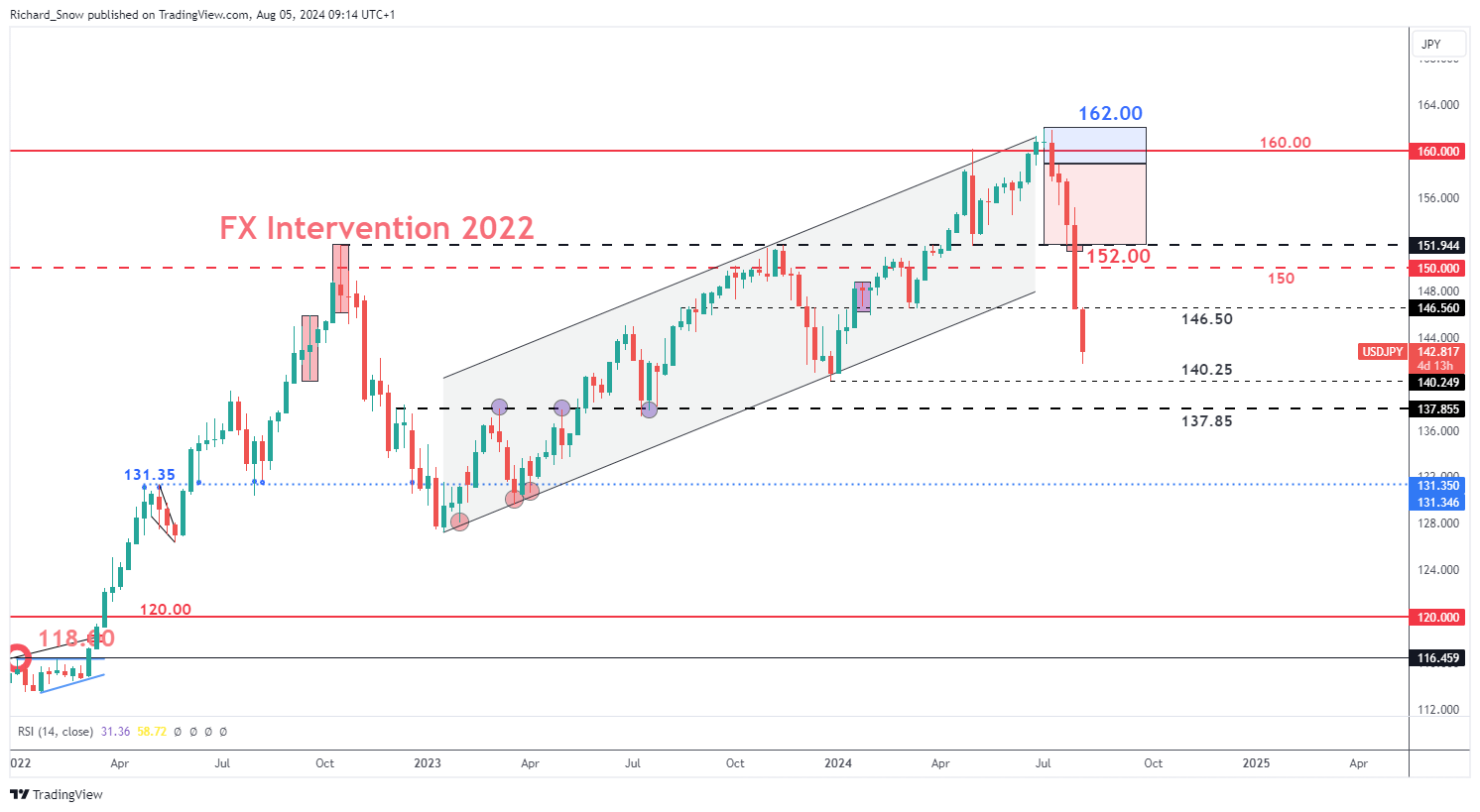

The yen is also a safe haven currency, meaning it stands to benefit from the rising tensions in the Middle East after Israel carried out targeted attacks on Lebanese and Iranian soil. Typically, index values fall when the local currency appreciates as exporters lose attractiveness and repatriated earnings translate into fewer units of the now stronger local currency.

USD/JPY Weekly Chart

Source: TradingView, prepared by Richard Snow

Will the Fed be Forced into Front-Loading the Rate Cutting Cycle?

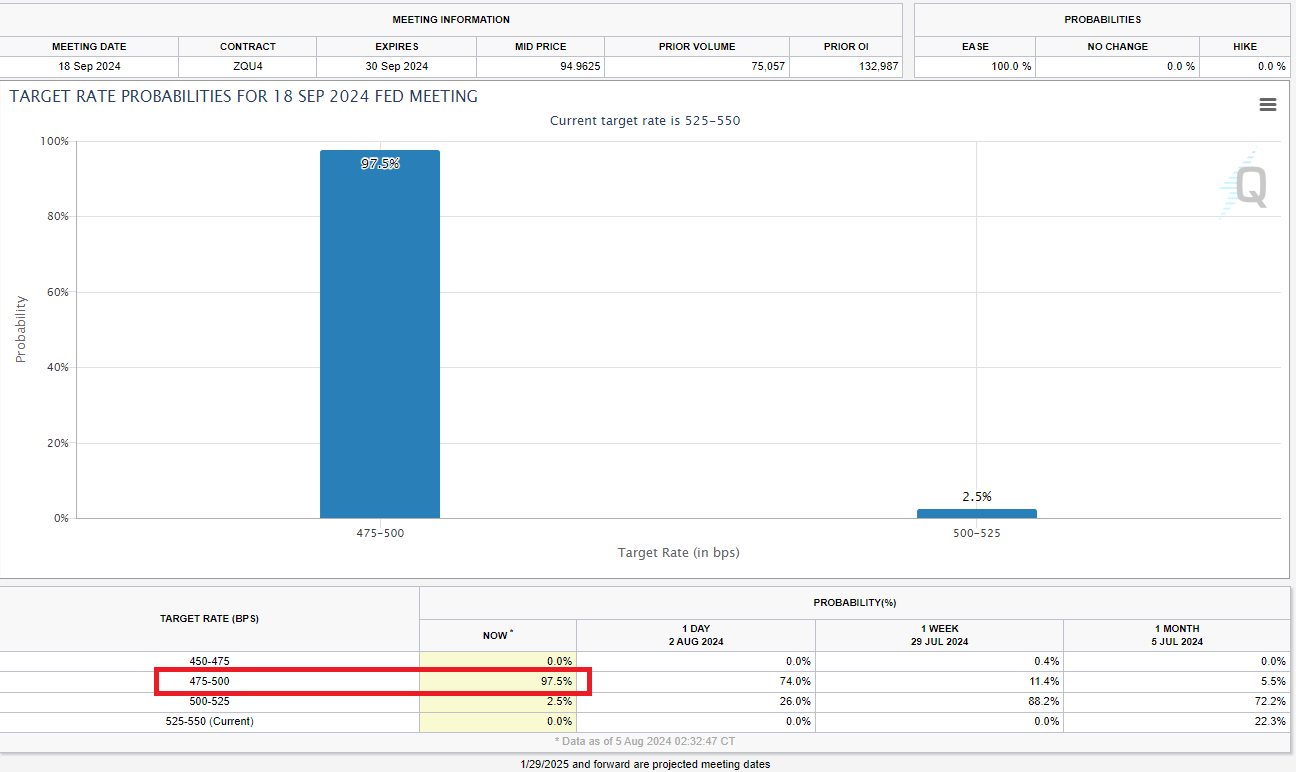

Markets are of the opinion that the Fed has made an error, keeping interest rates too high for too long in an attempt to keep inflation in check. On Wednesday last week the Fed had an opportunity to cut rates but instead kept rates unchanged and opted for a possible cut during next month’s meeting. Now, instead of a typical 25 basis point cut markets are nearly fully pricing in a half a percentage drop to kickstart the cutting cycle.

Implied Probabilities for the September Fed Meeting

Source: CME FedWatch Tool, September Fed meeting probabilities

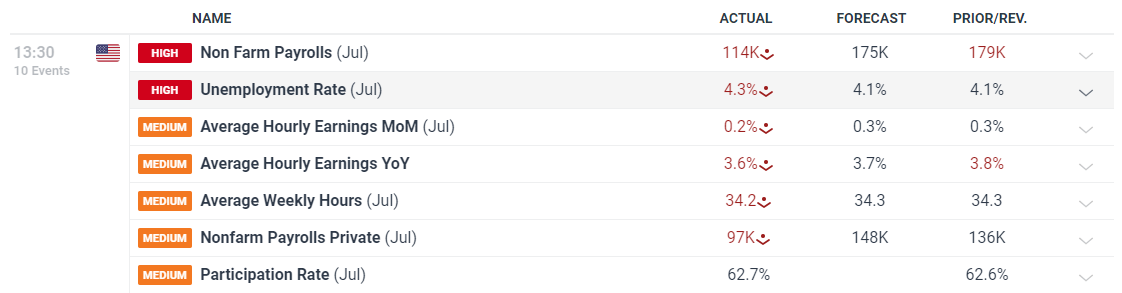

Hot on the heels of the FOMC meeting, Friday’s NFP data revealed the first real stress in the jobs market as the unemployment rate rose unexpectedly to 4.3{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38}. Easing in the labour market has been apparent for some time now but July’s labour stats stepped things up a notch. Prior, moderate easing was evident through lower hiring intensions by companies, fewer job openings and a lower quitting rate as employees have shown a preference for job security over greener pastures.

Customize and filter live economic data via our DailyFX economic calendar

Sticking with the jobs report, even analysts polled by Reuters expected a maximum move up to 4.2{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} and so the 4.3{3da602ca2e5ba97d747a870ebcce8c95d74f6ad8c291505a4dfd45401c18df38} figure provided a clear shock factor – adding to the already tense geopolitical developments in the Middle East after Israel carried out targeted strikes in Lebanon and Iran, inciting a possible response.

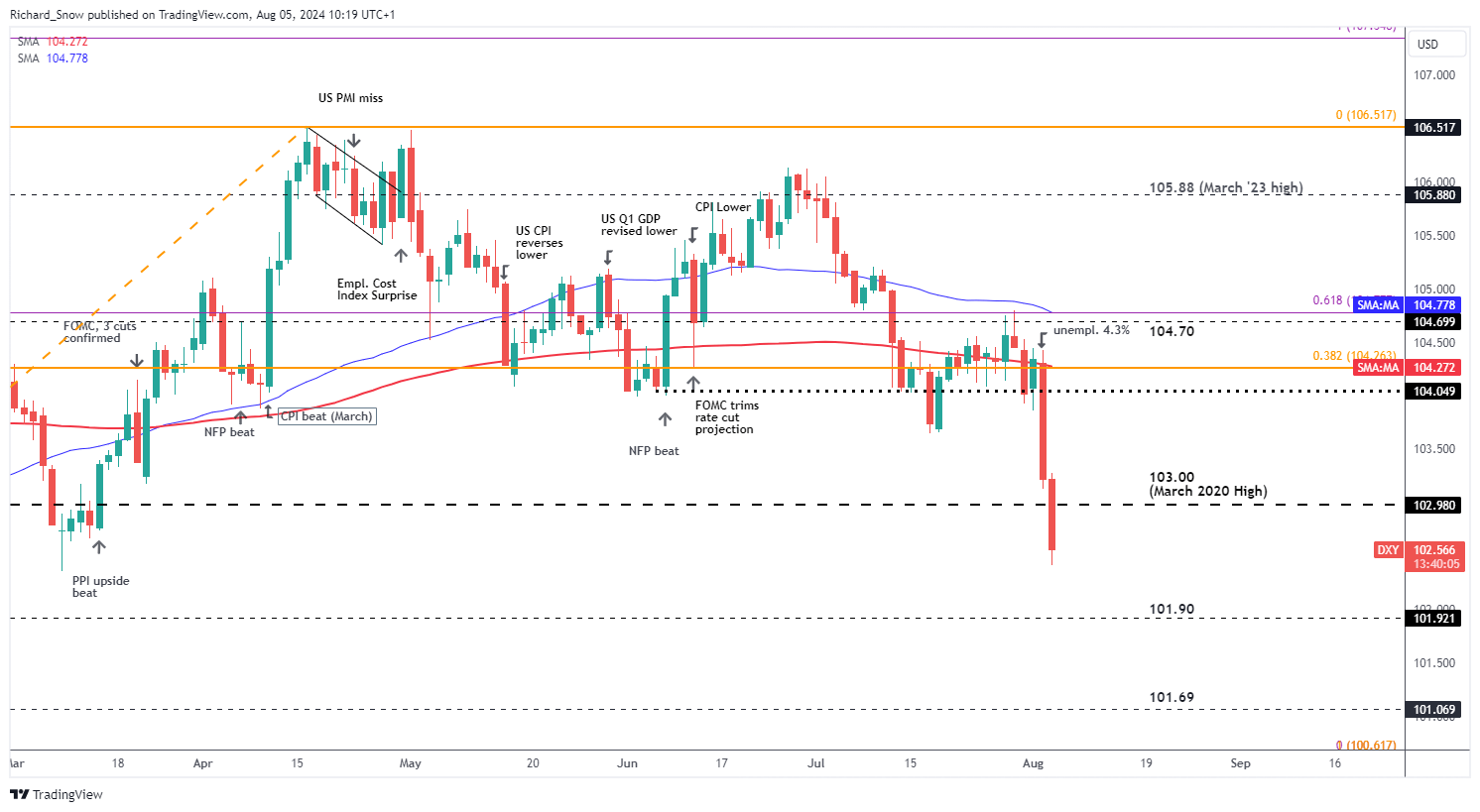

The dollar is well-known for being a safe haven asset but is unlikely to benefit from this appeal in the wake of rapidly rising rate cut expectations. US treasury yields are also retreating at a decent pace – reflecting market pessimism and the expectation that the Fed missed the opportunity to reduce the burden of elevated interest rates last month. The dollar story will continue to be driven by rate expectations for some time to come.

US Dollar Index (DXY)

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX